https://medium.com/media/dceea406bfd62c17708bd50501506784/href

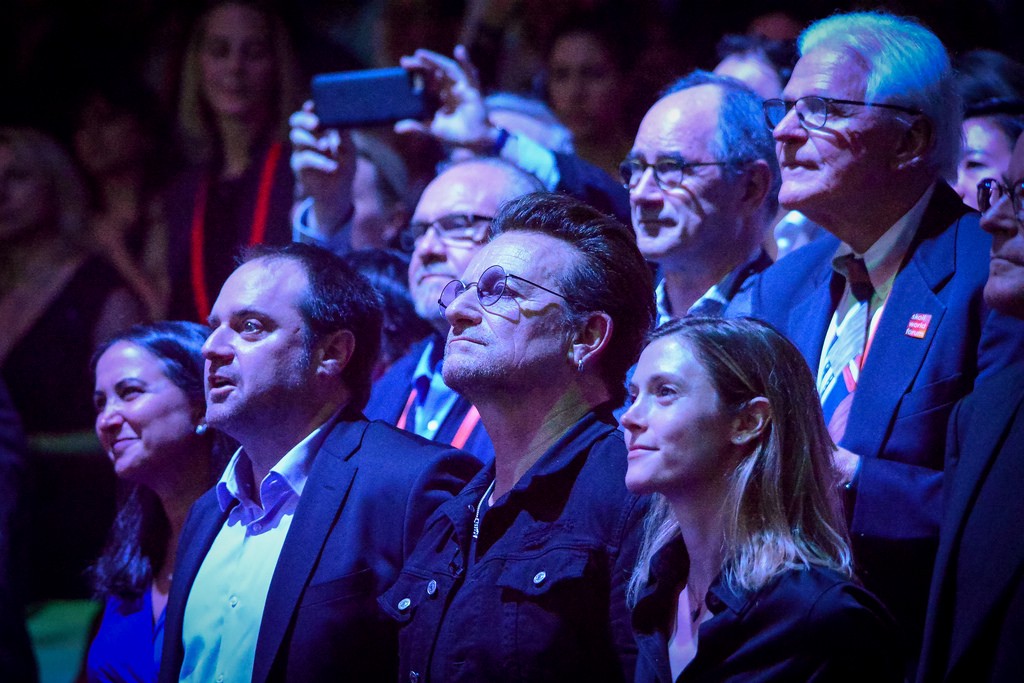

The new Rise Fund from TPG Growth had ImpactAlpha’s attention even without the star power of Bono, the U2 legend who is one of the fund’s co-founders.

The Rise Fund has come fast out of the gates in recent weeks with its first big-ticket investments, one in a growth-stage U.S. edtech startup and the other in an Indian dairy that buys from thousands of smallholder farmers.

So why did Bono feel compelled to diss other impact investors — twice? Is it really necessary to kick the hippies out of impact investing? Must investors really check any warm and fuzzy feelings at the door?

On our latest Returns on Investment podcast, we take up Bono’s comments, which he elaborated at the recent Skoll World Forum in Oxford after first making them in a New York Times interview in December. You’ll also want to hear Bono’s original impressions of TPG, the $74 billion private equity giant, which can’t (or at least won’t) be printed on ImpactAlpha.

The trash-talking, combined with the fund’s brash proclamation that it was raising $2 billion, means all eyes will be on TPG Rise. The firm should be able to produce rigorous impact reports, with metrics developed by billionaire investor Jeff Skoll, another co-founder, with help from Bridgespan Group consultants.

ImpactAlpha’s regular trio of podcast guests takes up the significance of the new fund, as well as the merits of Bono’s critique. Our lovable curmudgeon, Imogen Rose-Smith, a senior writer at Institutional Investor magazine, decries the particularly American obsession with bare-knockled capitalism; steady-as-he-goes Brian Walsh, head of impact at the fintech pioneer, Liquidnet, wonders who Bono is really talking to, and about; and your faithful correspondent, me, wonders whether there really are more “bad deals” in impact investing than in, say, venture capital or hedge fund investing.

Listen (and subscribe) to all of ImpactAlpha’s podcasts

https://medium.com/media/dceea406bfd62c17708bd50501506784/href