ImpactAlpha, Sept. 10 – Every day, with their commitment and their capital, impact investors and other Agents of Impact are writing a new narrative for business and finance.

And every week, ImpactAlpha tries to encapsulate that narrative, rounding up developments in our Friday Brief under a single phrase or word of the week: Urgency… Agency… Mobilization… Justice.

In its virtual summit this week, the Global Steering Group for Impact Investing – the GSG for short – has challenged practitioners around the world to craft a compelling narrative for impact investing. To prepare for the sessions on Friday, I’ve collected thoughts from my fellow panelists, which we share below.

From Central America, VIVA Idea’s Shannon Music calls for an inclusive and flexible impact investing community. In Paris, ChangeNOW’s Rose-May Lucotte explores how impact investing can cross the chasm from early adopters to the early majority. Amrit Ahuja, based in New Delhi, is using visual storytelling to cut through impact investing jargon. Fumi Sugeno of the Japan Social Innovation and Investment Foundation has been mapping the diversity of Japan’s impact investing ecosystem.

Impact Investing Australia’s Kadi Morrison has a simple elevator pitch: “Every dollar invested builds a better world.” The Skoll Foundation’s Shivani Garg Patel issues a challenge to elevate models where impact is both a deeply held value and a core component of the definition of business success. And Omidyar Network’s Chris Jurgens is linking impact investing to a broader narrative of reimagining capitalism.

I also looked back at our weekly words to collect some building blocks for narrative construction. The overriding theme is of an increasingly confident and mature financial marketplace and business ethos ready to supplant an increasingly archaic economic system. What we used to call “traditional” or “mainstream” finance has become simply “legacy” (in the sense of outdated computer systems due to be replaced).

- Repriced risk. The COVID crisis and social protests, along with climate change, have laid bare systemic risks. Accurately pricing them can drive a post-COVID economy that is equitable and sustainable.

- New norms. “Market rate of return” has lost meaning, if it ever had any. “Fiduciary duty” incontrovertibly requires diligence on systemic risks. The whole system’s license to operate now rests on ESG – environmental, social and governance performance.

- Purpose-built prototypes. Writ large, impact investing represents a prototype for the new economic system emerging. As the world tries to grapple with COVID and climate, racial injustice and inequality, it’s arriving at purpose-built vehicles and approaches incubated, in some cases for decades, by community and impact investors.

There’s no need to ask anybody’s permission. No invitation is needed. From now on, long term value and growth comes from positive environmental and social impact. The old order will have a long tail, to be sure. But the COVID crisis has confirmed there is no business as usual; capitalism itself needs the reset, the refresh, the reimagining that impact investing represents.

And so do capitalists. Just as investors sometimes go “risk off,” more and more are going “impact on.”

One additional point: The GSG has asked for help to “Persuade the Powerbrokers,” with particular attention to the financial sector and governments. That narrative framing itself may already be putting impact investing behind the curve. The investment case for ESG and impact is well on the way to conventional wisdom (witness UBS’s recent adoption of sustainable investing as the preferred solution for all of its $2.6 trillion in client assets).

What’s less obvious is whether impact investing can credibly deliver what unreimagined capitalism so obviously hasn’t. A rising popular movement is not interested in a marginally better flavor of asset or wealth management, but in the mobilization of human, social and financial capital for an inclusive, sustainable and just world.

“The answers we have as an industry are nowhere near what is needed for us to be able to credibly sit down with those people and say that we are a legitimate way to organize resources,” Nonprofit Finance Fund’s Antony Bugg-Levine said on a recent Agents of Impact Call. “We are at our core plutocratic and technocratic and people are pissed off and sick of it.”

Inclusive and flexible

VIVA Idea’s Shannon Music contributes to solving Latin America’s key sustainability issues through research, capacity building, and knowledge management. She has been a leader in building Central America’s impact investing ecosystem and co-chairs the GSG’s Central American regional advisory board, the Plataforma de Inversión de Impacto Centroamericana (PiiC). She offered these guideposts:

Early stage. Impact investment is at a much earlier stage in Central America, and it is still a conversation within more niche players. Many of our region’s investors do not self-identify as impact investors, even though many of their investments are in fact having great impact, if only because much of our region has so many needs that many investments do provide very important help to excluded communities, etc., even if this is not the primary intention.

Flexible. Those players that do enter the impact investment ecosystem, find that it is not possible to specialize and play a single role (e.g. investor), and that they need to expand to other roles to improve their chances for success (e.g. also add an award or other mechanism to get leads on organizations, include an incubator arm to their organization, etc.)

Big tent. I believe that for Central America it is not that valuable to have a fundamentalist view about impact investment, where only certain investors or organizations “qualify” as impact investors and we spend lots of time differentiating between organizations and excluding those that do not meet our high bar. I believe it is more important to have a more inclusive perspective that tries to move everyone up the impact ladder and focuses on improving our actions each step of the way.

Crossing the chasm

Rose-May Lucotte is the co-founder and COO of ChangeNOW, world’s largest gathering of entrepreneurs for the planet.The third edition took place in Paris in January 2020, gathering 1,000 solutions and 28,000 participants coming from all around the world. She challenged impact investors to look beyond their bubble and craft a compelling narrative.

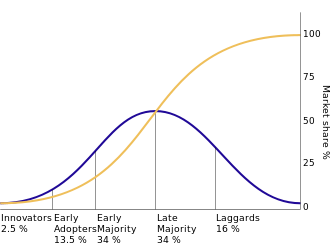

Everett Rogers’ adoption curve for any product (or ideology or movement…) identifies five stages: innovators, early adopters, early majority, late majority and laggards. In the field of impact, we are today at the key moment when we have to move from the early adopters to the early majority.

The discourse that has seduced innovators and early adopters is not the one that convinces the majority. The gap between them is Geoffrey A. Moore’s famous “chasm.” Crossing the chasm between early adopters and the early majority requires a new narrative: new codes capable of speaking to the greatest number.

When we created ChangeNOW, the challenge was to cross this chasm, to inspire widely around the positive impact. To do this, we sought mainstream designs and codes, inspired by the mechanics of the major events of the moment, especially those of tech (CES, TED, etc.), applied to the themes of impact. We also paid particular attention to our semantics and storytelling, which played a key role in broadly federating, in particular by showing that the impact movement and all positive impact innovation is in line with history.

And indeed, we are living through one of those decisive periods in history, as were the Enlightenment, the French Revolution and the Industrial Revolution. With this time, the challenge of saving the planet, and the future of mankind on earth. Limiting global warming, protecting biodiversity, building sustainable and desirable cities, combating ocean pollution, developing green mobility, managing migratory crises… the challenges of our century are numerous and unprecedented.

Our narrative was the following:

About 150 years ago, the world was experiencing the industrial revolution. In order to accompany this revolution, “world exhibitions” were invented. Showcases of progress at the time, they highlighted the state of the art of world industry, to inspire the greatest number and bring together players in sectors undergoing transformation.

Today, we are living a new revolution, which is both ecological and social. To meet these challenges, men and women around the world are acting and innovating collectively. In the same way, we need to show what is best in the world, and make it widely known, to accelerate this transition.

That’s why last January, with ChangeNOW, we created the first Universal Exhibition of Innovations for the Planet. We returned to one of the emblematic sites of the industrial revolution of 1900, the Grand Palais in Paris. More than 28,000 participants from all over the world were present last January. That’s six times more than for the second edition, in 2018.

It’s a sign that we’re at the tipping point where the early majority is climbing on the subject. This early majority is in turn key to convincing and getting the power brokers on board – and having them go in the direction of history.

Visual Storytelling

Amrit Ahuja, based in New Delhi, is working with the Michael & Susan Dell Foundation India and Social Finance India. In 26 years of communications work, she has excelled in creating markets and narratives for new concepts. She led communication for satellite TV when India had not heard of satellite TV and was communication director for Facebook India until last year.

Impact funding is a term understood by very few, as the practitioners who speak about it are investors, tool creators with a “finance head.” They believe everyone understands the complexity of numbers, scale and impact.

I often hear them say, ‘What is measured is outcomes and you pay for outcomes.’ Or, ‘Measurement is important to have systemic reforms,’ and ‘You have to benchmark against a control group to see how the impact has been on another group.’

All of the above sounds like a good cocktail of English language picked up from a finance dictionary. I wish we could work as a group to create a glossary of terms for dumb or the common man.

There is a need to describe impact funding through simple visual tools.

Here is an example of a visual storyboard that was created for a aata impact bond in the area of education (key partners MSDF, UBS, BAT and more).

I feel we need to think of these simplistic visual storytelling to explain what impact funding can do.

Mapping Diversity

As head of business development for the Japan Social Innovation and Investment Foundation, Fumi Sugeno leads SIIF’s impact investments and ecosystem building projects. As the national advisory board secretariat for the GSG in Japan, she co-hosts the “Impact Investing Roundtable” with the Financial Service Agency of Japan. She reflects on the tension between standardization and diversity and innovation.

In order to scale impact investing with integrity, we need to develop and share standards, such as the definition, core characteristics, impact measurement and management principles and high-level framework. On the other hand, impact investing is and should be diverse investment practices to leave room for innovation and localization.

This diversity makes impact investing appear to be complicated and not straightforward. However, I think it is challenging but important to develop a narrative that can embrace such diversity of impact investing.

In our “Impact Investing Roundtable,” with 35 representatives mainly from financial institutions, we first conducted a survey among the representatives and mapped them according to their stances on risk/return/impact spectrum, their interpretation of fiduciary duty etc.

We started our roundtable discussion by helping the representatives recognize how diverse impact investing practices are even among mainstream financial institutions.

At SIIF, we also emphasize on developing and demonstrating symbolic success cases since real stories can be more powerful than thousand words.

Elevator Pitch

Kadi Morrison, director of strategic communications and engagement at Impact Investing Australia, begins with a quote from Marcel Proust: “The real voyage of discovery consists not in seeking new landscapes, but in having new eyes.”

For many of us there is an underlying belief in a ‘fair go.’ Many Australians believe (maybe inaccurately) ‘fair go’ is the essence of the Australian character, the thing that sets us apart. This is my elevator speech to the Australian government:

The magnitude of this crisis is unprecedented. This on top of drought, heatwaves and devastating bushfires in Australia has exposed weaknesses in our system.

Despite this Australians have demonstrated a healthy level of solidarity and commitment to the common good.

Harnessing this spirit of decency will enable us to reshape our society where a ‘fair go’ is not a slogan but part of our social fabric, where everyone can prosper.

Every business and investment decision needs to consider social impact alongside profit. You can create the framework to accelerate impact investing to achieve this.

History shows that crises like these have been pivotal in fuelling innovation and steering economies on a new path.

This is our golden opportunity, let’s embrace it.

Imagine being the government who built an economy to meet the needs of future generations, where every dollar invested builds a better world.

Long-term imperative

As chief strategy officer for the Skoll Foundation, Shivani Garg Patel helps guide the foundation’s strategic priorities around inclusive economies, racial justice, and pandemics.

One major challenge we face is how to move power brokers to action in a way that gets below the surface, beyond activities and outputs and

Another challenge is the fact that many at the forefront of impact efforts lack the scale and access to become visible to the power brokers (e.g., impact entrepreneurs). How do we elevate their models and get them in front of the ones in power? Telling their stories within impact circles is crucial, but that alone may not yield the scale of impact possible. This is also vital when aiming to move to spotlight the solutions and efforts based in geographies and communities that are underrepresented in the mainstream.

We need a fundamental narrative shift around social and planetary impact, from being thought of as an add-on, to something that is imperative for long-term business success. Data shows that factoring in longer-term views and impact leads to better outcomes. For example, this recent New York Times article, “Investing in Social Good Is Finally Becoming Profitable. “

We must spotlight those in power who can be leading examples of the future we want to see and drive those efforts as a call to action for others to participate. Are there leading companies globally, consortiums, governments that can show both what is possible and what is imperative?

Finally, how can we use associations and intermediaries—Business Roundtable, Aspen Institute and others —to help endorse and disseminate these examples and possible paths forward?

Reimagining Capitalism

Chris Jurgens is a director on the Reimagining Capitalism team at Omidyar Network. He leads the firm’s strategy and portfolio of work focused on how corporations and capital markets can contribute to a more inclusive capitalism, and oversees the firm’s portfolio of impact investing field building work.

Point No. 1: There is an opportunity to better link impact investing to the broader narrative of “reimagining capitalism” and fixing what’s broken in the way our economic system works today.

We must acknowledge that impact investing as a movement has made great progress in the last decade – but that change in business and capital markets is not happening fast enough, nor at sufficient scale to meet the greatest challenges our economy and society are facing today.

Rising inequality and declining economic mobility. Wealth and power are becoming more concentrated. The failure of public and private institutions to address legacies of structural racism, and the existential threat of climate change. Declining trust in institutions and a prevailing sentiment that the system is rigged.

These failings of our economy were clear before the current COVID crisis and heightened attention on pervasive racial injustices – and have become that much more painfully apparent since – as we see its disproportionate impacts on those who have the least power and voice in the current system.

At Omidyar Network, we believe we need fundamental structural change in our economic system to address these fundamental challenges. This is what drove Omidyar Network to take on ‘reimagining capitalism’ as one of the pillars of our philanthropic work. We see this as building on our work over the past decade to help build and grow the impact investing field and movement – but with an even more explicit focus on structural change to capitalism as a system.

We are capitalists that believe we need to reimagine capitalism. And we believe impact investing we think is integral to this task

Point No. 2: To be credible, particularly in the current political climate, the narrative on impact investing has to have stronger messaging on how it addresses the most pressing systemic challenges of our day – inequality, injustice, climate, concentration of power – as well as the current crises we face.

We’ll need multiple messages to reach, engage and influence multiple audiences.

Where we’ve seen impact investing messaging get stronger in recent years is in seeking to address mainstream investors and business actors, showing how you can align investment with values, and enable opportunities to “do well by doing good.”

This is a useful narrative in making the case to mainstream investors to engage in ESG and impact. This sort of narrative is necessary but not sufficient.

We also need clarity on how impact investing addresses the harder issues:

- Inequality. How does impact investing address rising inequality? How is it bringing the most vulnerable into markets and opportunity?

- Power. How does impact investing generate broader based empowerment? Is it perpetuating current concentration of power – i.e. those with capital?

- Rules. Is the impact investing movement willing to take bolder stances on policy and rules that would shift the system, and address concentration of wealth and power – e.g. taxation, regulation, financial sector reform, etc.?

- Resilience. How does impact investing make our economy and society more resilient in the face of crises like COVID?

Point No. 3: There is an opportunity to be clearer and more explicit about the vision we are shooting for in the impact movement, at the next level up of a new economy.

We see potential to frame this around a fundamentally different role for business and finance in a reimagined capitalism:

- Purpose of the System. A future in which our economic system is oriented towards delivering individual empowerment and societal wellbeing, not solely profit and wealth generation.

- Purpose of Business and Finance. A future in which companies and financial institutions are anchored on a core societal purpose, and play an active role in solving society’s most significant challenges.

- Power. A future in which power is rebalanced – between Wall Street and Main Street, employers and workers, large incumbents and start-ups.

- Markets and Rules. One in which markets are structured to incentivize business activity which generates value for society, and to curb extraction and exploitation.

- Societal Value, Not Shareholder Value. A future which the most consequential business decisions are made based not primarily on their contribution to the next quarterly earnings target, but on how they create value for a business and its core stakeholders in the long term.

Point No. 4: A compelling narrative should help show audiences how the impact investing movement gets us to that reimagined future – not only through the actions of individual entrepreneurs and investors, but through fundamentally changing the system.

We’ve made progress in showing how impact investing contributes to the SDGs – and particular goals around climate, health, energy, agriculture and food. This is important.

But we also need to do a better job of conveying how the impact movement can lead to an overall system that is more just and inclusive. How can the impact investing movement contribute to shifts in how investment and business decisions are made? How can impact investing change who has voice and power in such decision making?

This is harder, but we think an important part of the next chapter.