https://medium.com/media/8cd6de71183ac169f21e3fdc670a02aa/href

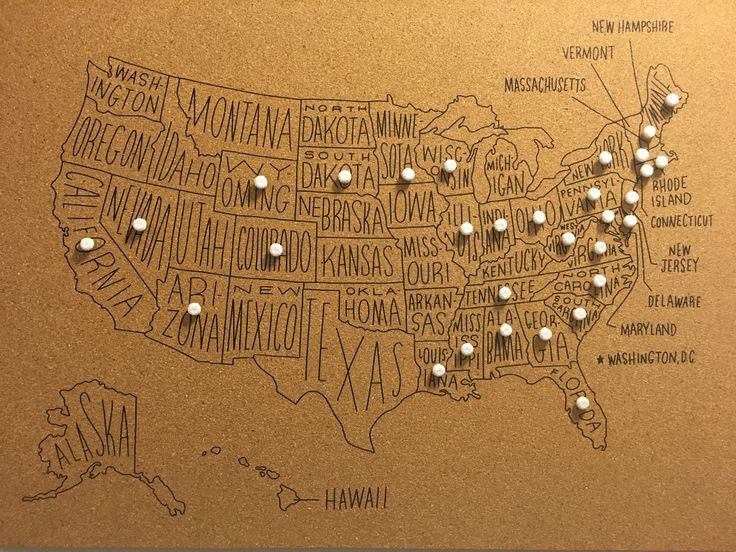

First came the bus tour. AOL founder Steve Case’s Rise of the Rest tour has visited 33 cities in four years, meeting with entrepreneurs and civic leaders far from the coastal enclaves that usually command the attention of tech titans and venture capitalists.

Along the way, Case has allied with folks like J.D. Vance, the author of “Hillbilly Elegy,” and Village Capital’s Ross Baird, who has built an entire thesis (and new book) around the notion that outsized returns are possible if investors look beyond well-trod geographies and demographics.

Steve Case wants to revolution-ize entrepreneurship in middle America

Then came the fund. Case assembled a Who’s Who of limited partners in raising $150 million for the Rise of the Rest fund (part of his Revolution venture firm), including Jeff Bezos (Amazon), Eric Schmidt (Alphabet/Google). Howard Schultz (Starbucks), fashion designer Tori Burch and assorted Waltons, Kochs and Pritzkers, along with the founders of KKR and Carlyle Group.

That was enough to attract the attention of Andrew Ross Sorkin of The New York Times. Sorkin, the mastermind of the Times’ Dealbook site, has made a sub-specialty of prompting impact investing types to make disparaging comments about impact investing (cf. Bono), apparently in order to demonstrate their investment bona fides.

“We’re fans of impact investing,” Case told Sorkin, “but we actually didn’t position this as an impact fund. First and foremost, our goal was to generate top returns.”

Steve Case attracts a Who’s Who of business to his Rise of the Rest fund

That brought the backlash. “You may disavow this as an impact investment, but we see you,” Nonprofit Finance Fund’s Antony Bugg-Levine, told Case on LinkedIn. “Seeking potential financial return in parts of the economy neglected by biases of mainstream investors is a common theme for impact investors from those who began investing in US inner cities in the 1970s, to microfinance lenders in rural India, to VCs backing off-grid solar in East Africa today.”

On ImpactAlpha, Tideline’s Ben Thornley called on Case to embrace impact, not run from it. “Why not ensure that good quality jobs materialize? That wealth trickles down to employees and communities? That products are net-net “better” for society?” Thornley asked. “Otherwise, how will Case and his co-investors know The Rest are actually Rising?”

Thornley called Case’s disavowal of impact “a shame” and “a missed opportunity to educate a tremendously influential group of business leaders.”

Rise of the Rest should take pride in impact — not run from it

Which begat Case’s rebuttal. ImpactAlpha strives to provide a forum for reasoned debate, so we were pleased that Case chose to publish his response here. “I wanted to set the record straight: I absolutely believe that impact investing can produce the same sort of market returns that other types of investing can achieve,” Case wrote. “If my comments in The New York Times suggested otherwise, that was not my intent.”

Case went on to explain that Rise of the Rest does indeed have impact intentions: “My passion for what we’re doing with Rise of the Rest lies in the idea of leveling the playing field, so everybody, everywhere has a shot at the American Dream. Not a day goes by that I don’t stress that aspect.”

But the fund doesn’t have plans to measure or report that impact, and thus can’t claim to be an “impact fund” by the criteria set by none other than the Case Foundation, run by his wife, Jean Case. (ImpactAlpha contributed to the Case Foundation’s “A Short Guide to Impact Investing,” which lays out that framework.)

“Right now, we are focused on the most immediate problem,” Case wrote, “getting capital moving — quickly — to startups that need investment to get off the ground.”

How Rise of the Rest will have impact — and why it’s not an impact fund

Bringing us, at last, to the latest Returns on Investment podcast. A regular in our roundtable, Imogen Rose-Smith, late of Institutional Investor magazine and now an investment fellow with the University of California, said investors — all investors — can no more choose not to measure impact than they can choose not to measure financial performance.

“As an investor, why would I give you my money if you’re not measuring and reporting,” Rose-Smith said. “This suggests that this is somehow redundant or voluntary or unimportant.”

https://medium.com/media/8cd6de71183ac169f21e3fdc670a02aa/href

I made the heretical confession that “impact measurement” discussions had often left me cold. I changed my mind as a result of the Rise of the Rest discussion.

“If you have an impact thesis that says ‘We’re going to put capital to work in places that are capital-starved, and as a function of that there is alpha — dare we say ‘impact alpha’– returns,’” I suggested, then “you better be measuring it to know whether you’re headed to the right target, and to know when you got there. So it’s not an optional case. It’s the whole basis of your fund’s investment thesis.”

There may be more chapters yet to be written. Case himself left the door open, saying, “We look forward to exploring ways we can expand our efforts over time. We remain excited by the surge in activity in impact investing.”

I suggested that Rise of the Rest’s positioning on “impact” may shift rather organically, since at least some of the limited partners seem to have invested in the fund precisely because of its intended impact, and so may well want some reporting on that impact. TPG Growth’s Rise Fund and Bain Capital’s Double Impact fund raised $2 billion and $390 million, respectively, with explicit impact intentions and reporting.

“We may be seeing that this is the last of the funds saying, ‘We’re not calling it ‘impact’ so we can raise some money.’” I said. “Maybe the next set of funds will be saying, ‘We are calling it ‘impact’ so we can raise some money.”

https://medium.com/media/8cd6de71183ac169f21e3fdc670a02aa/href