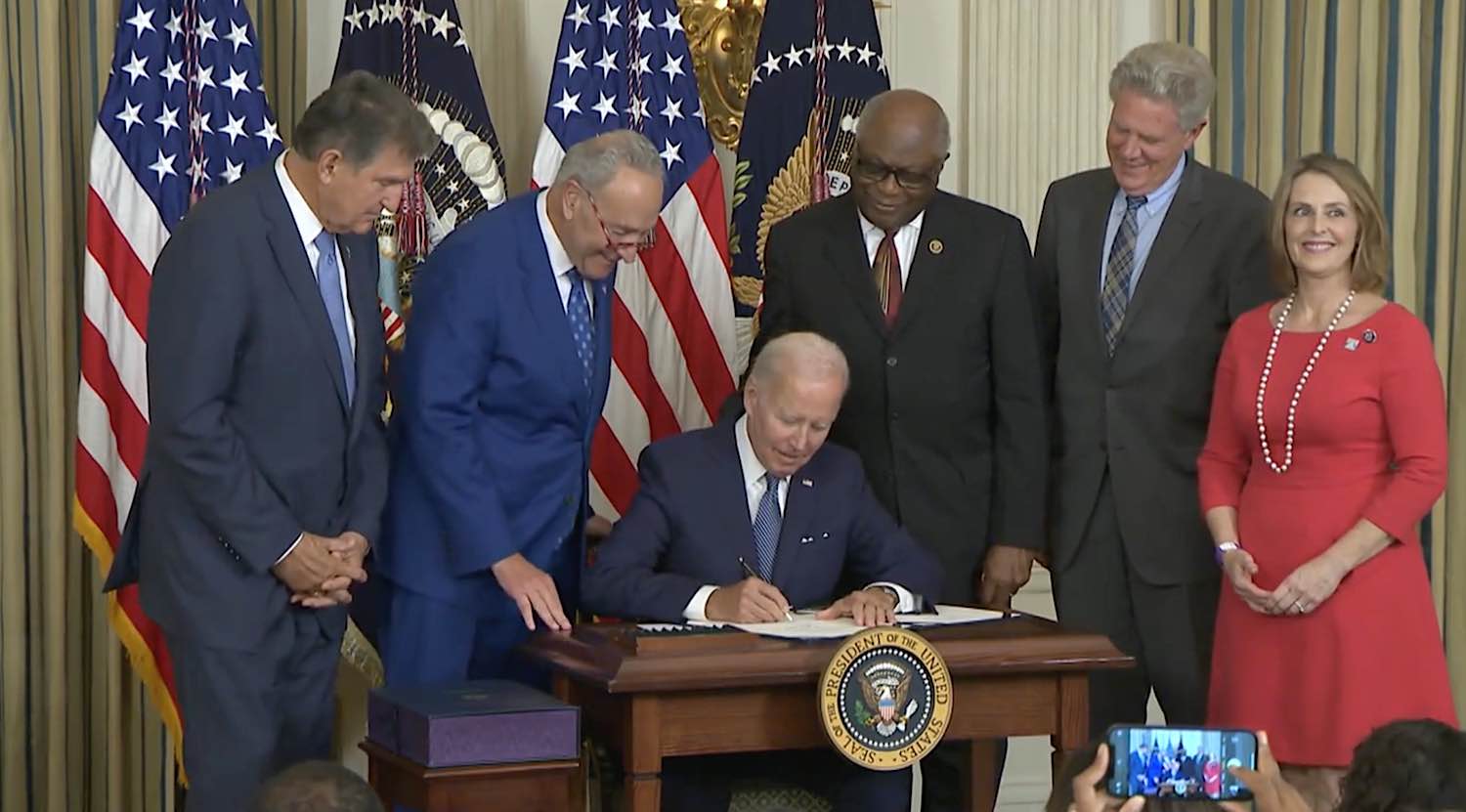

ImpactAlpha, April 26 – The trio of climate and economic legislation signed into law by Joe Biden in the first two years of his presidency will be central to his re-election campaign, which he kicked off this week.

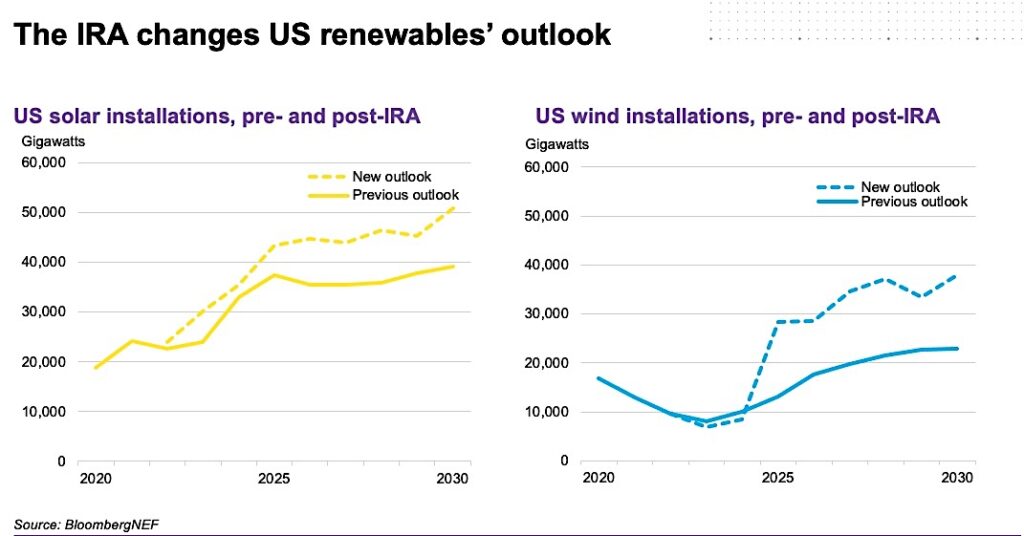

Eight months after the passage of the Inflation Reduction Act, the sweeping climate and industrial policy law is reshaping the U.S. economy and speeding the low-carbon transition. Some 600 gigawatts of new solar, wind and storage are expected to come online in the U.S. by 2030, enough to power more than 100 million homes, BloombergNEF forecasts.

“The federal government is finally moving in the same direction as the market,” said Michael Bloomberg at the opening of the BloombergNEF conference this week in New York. “The more that the private sector recognizes the opportunities and the more the public sector helps create them, the more progress we can make.”

BNEF analysts have twice revised their numbers upward to reflect the rapid uptake. The IRA will lift solar installations by 30 gigawatts by 2023 compared to the firm’s pre-IRA forecast. Wind capacity is set to nearly double by the end of the decade. Energy storage will grow nine-fold.

Since the legislation passed, corporations have announced $52 billion in EV and battery investments.

The momentum comes despite challenges such as permitting and grid interconnection for the renewable energy capacity being built.

“The economic argument has been won,” BNEF’s Pol Lezcano told ImpactAlpha. Corporations, utilities and individuals want to buy clean power, he said; the challenge is completing enough projects to supply that demand.

“It’s about ensuring that we invest in grid infrastructure and reform permitting to allow the sector to scale up and meet the demand.”

Investment grade

The Department of Energy’s Loan Programs Office is playing a central role underwriting loans and guarantees for first-of-a-kind facilities, EV manufacturing, next-generation energy infrastructure and power plant retrofits where commercial banks won’t step in (listen to the podcast, “Jigar Shah on building a $140 billion ‘bridge to bankability’ for the energy transition”).

The IRA provided additional funding for the office, which has about 135 active applications seeking more than $120 billion in loans. Three projects have drawn funds. In a portfolio review, the LPO grades its loan book BBB-, the first time it has reached investment grade.

“It really goes to show the role of the loan programs office,” said its head, Jigar Shah. “Over time, as the marketplace catches up, the portfolio actually reaches investment grade. That is the underlying thesis and it has proven itself out.”

New-age nukes

The climate crisis has changed the politics of nuclear energy. A new generation of small, modular nuclear reactors could drive large-scale carbon reduction and replace coal and other fossil fuel plants around the world.

“The legacy of this office is going to be small modular reactors,” said Shah. The office has around $14 billion in loan applications for nuclear-related projects, from fuels to plant upgrades. Between 2014 and 2019, LPO issued loans of nearly $12 billion to Vogtle Electric Generating Plant, a nuclear reactor nearing completion in eastern Georgia.

“Solar, wind, geothermal, low impact hydro… we need to scale it all up,” said Shah. But advanced nuclear is a crucial gigaton-scale solution that the U.S. can commercialize and export, he added. “I do think we’re right at the center of it.”