With so many frameworks and schemas, the fragmentation of impact investing continues to frustrate. The latest to try their hand at coordination is today’s convening in New York of the Good Capital Project, the first initiative under the new ownership group at SOCAP, the annual social capital markets conference.

The day was organized around a half-dozen “Grand Challenges” for impact investing, such as “enabling the entrepreneur” and “impact measurement and management” with the intention to create protocols, or at least translations, between diverse approaches. The crowded room included many impact investing A-listers, but organizers insisted the event was different from the kind of “summit” claimed by some other organizers on this year’s impact event circuit.

“‘Summit’ assumes you already know everybody you need to know and gather them together. That has failed multiple times,” Kevin Jones, a convener and himself a bridge between ‘old SOCAP’ and ‘new SOCAP,’ said before the event. Rather, Jones said the goal is to turn “valuable strangers” into “unlikely allies” to expand both the network and the solutions. “We are hurt by the misguided events of the top-down synthesizers before us,” he said.

Design workshops

The day kicked off with the requisite panels, but the core were a half-dozen four-hour design workshops for each of the grand challenges. The “Investable Solutions” group, for example, was charged with “providing clarity between investment opportunities that are and are not concessionary,” as well as between sectors ready for commercial returns and those in need of subsidies.

The product design and distribution group was asked, “How do we learn from traditional asset managers who have long mastered the ability to launch a product that fits nicely on the shelves of banks or brokerage firms to be seamlessly delivered to the end-consumer?”

Many of those A-listers stuck around for much of the day. The program included Deval Patrick, the Bain Capital partner and former Massachusetts governor (who bought lunch), Morgan Stanley’s Hilary Irby and UBS’s Stephen Freedman. Helping lead workshops were Cornerstone Capital Group’s Erika Karp, the ImPact’s Abigail Noble and Bridges Ventures’ Brian Trelstad, among many others.

The day’s Twitter stream (#SOCAPGCP) suggested a lively discussion. Duke’s Cathy Clark observed, “These two approaches, bottom up and top down, are converging. We are in the maelstrom.” Jed Emerson played his role as resident conscience and scold, “We can’t remove the learning curve and passion of human inquiry (from impact investing) just because we are trying to sell it.”

Capricorn Investment’s William Orum pointed to the competitive advantages “Impact investing is long term, there are inefficiencies and barriers to entry. This all creates more opportunity to widen returns,” he said. And Invested Impact’s Rodney Foxworth asked the hard question: What is impact investing (and the Good Capital Project) going to do about structural racism?

Collaborative effort

SOCAP’s chairman, Robert Caruso of Kantian Ventures, who lead the new investor group said the Good Capital Project is not competitive with other efforts. “We want to engage every stakeholder that shares our goals.”

he said.

Jones promised the open collaboration would continue when the day was done. Eventual outcomes, he said, might include a Market Impact Report to help development banks and others determine when subsidies are helpful or hurtful. Or a way to talk about community development financial institutions, or CDFIs as “a phenomonal risk-free impact investing opportunity.”

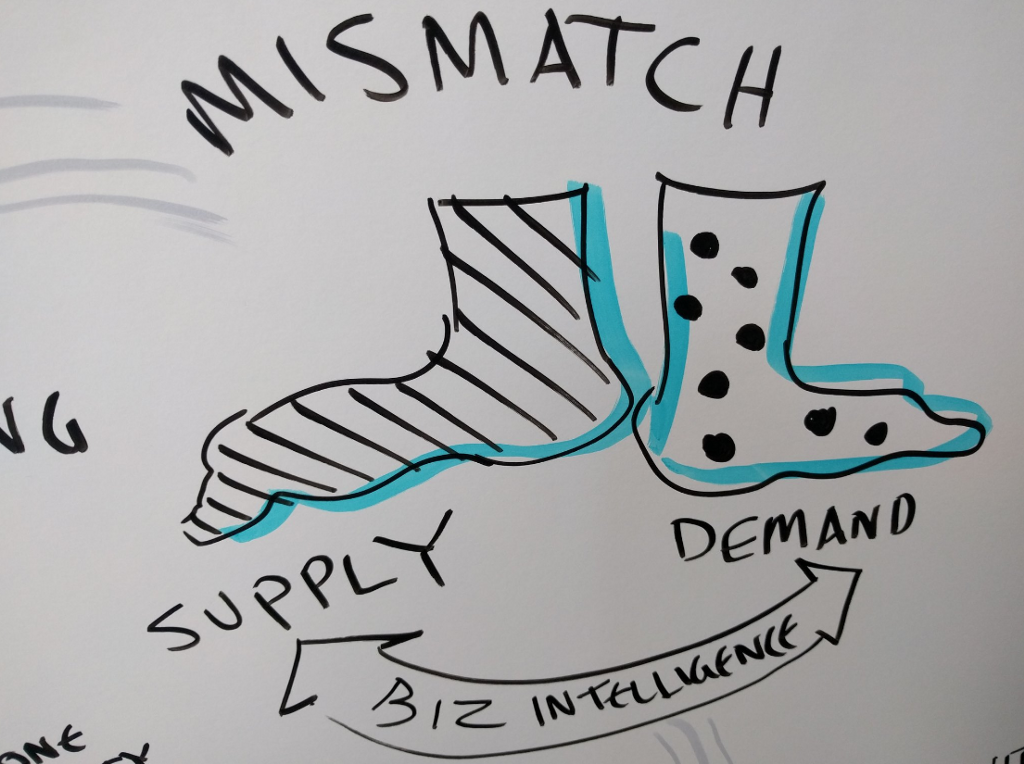

“Across these sectors, we need to get to coordination. We need to translate. We need to not get hung up by myopic true-believer metrics,” Jones said. “The goal is to get to where we are coordinating capital flows and systems become automated and you accelerate the flow of capital to good.”