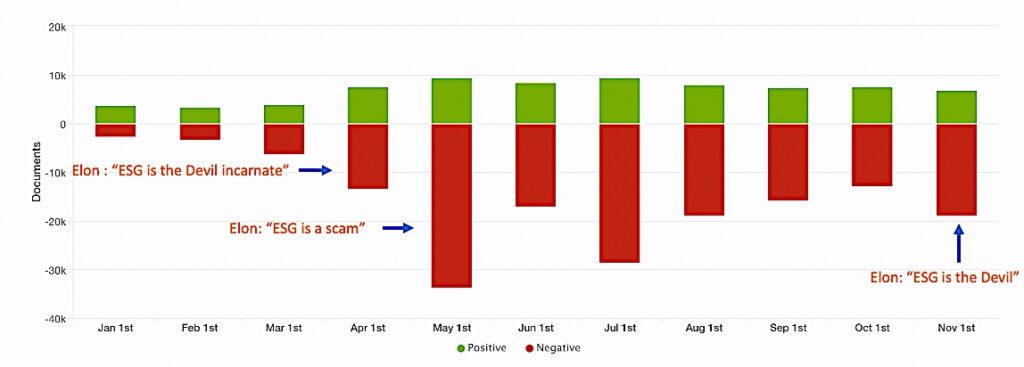

Crypto-evangelist Dan McArdle was apparently peeved with ESG when he tweeted: “Clothes dryers in the US use more energy than all bitcoin mining… so not doing your laundry must be *very* ESG.” Silicon Valley legend Marc Andreesen playfully piled on, “Not showering is ESG.” Then, like an overweight man cursing the results on a weight scale, Elon Musk, then the world’s richest man, added somewhat ominously: “Corporate ESG is the Devil Incarnate.”

Little did we know this otherwise obscure exchange between aggrieved billionaires back in April prophesied the tumultuous year ahead for Elon and ESG.

A month later, on the heels of Tesla’s expulsion from Standard & Poor’s admittedly mislabeled ESG fund, Elon was less metaphorical and more slanderous: “ESG is a scam.” In one fell swoop, he managed to accuse 90% of pensions, 70% of CEOs, 85% of Americans, and 67% of institutional investors of either being scammers themselves, total rubes, or both. Yes, that includes you, dear reader.

Why would S&P remove what was a high-flying stock, expose an obvious contradiction in its index, and risk the wrath of a mercurial billionaire? Tesla is “one of the most controversial companies in the world,” ESG researchers at Truvalue Labs warned in the Harvard Law School Forum on Corporate Governance. Tesla’s woeful ESG reporting “demonstrates a range of governance issues for shareholders.” Wikipedia lists at least 1,200 active lawsuits involving Tesla, noting, “a significant amount of the cases notably derive from the actions of the company’s CEO, Elon Musk.”

Among Tesla’s hundreds of governance infractions that made headlines are SEC probes, false Autopilot claims, and underreporting environmental data. In the ‘S’ category are many more: a $137 million racial abuse settlement, another $1 million award for racism, an alleged culture of racism, and sexual harassment lawsuits.

Risk management

Turns out, removing Tesla from S&P’s ESG index wasn’t just reasonable, it was long overdue. Had S&P relied on the puckish charm of everyone’s favorite middle school billionaire, rather than ESG data, their index would have suffered from the ensuing precipitous drop in TSLA’s value.

Tesla shareholders tacitly understood the stock’s stratospheric rise had as much to do with the carmaker’s revolutionary vehicles as the CEO’s “Iron Man” reputation. But, as it turned out, overlooking Elon’s total disregard for environmental, social and governance issues came at an exorbitant cost. What is it they say about living by the sword?

By tweeting every “dumb mistake” in his governance-free takeover of Twitter, @elonmusk has effectively become the world’s most effective ESG data provider. Each unhinged tweet that turns into a damning headline becomes an undeniable material risk for shareholders of Tesla, Twitter and SpaceX. (Tesla shares popped after the Twitterverse, responding to a poll Musk said he would abide by, suggested he should step down from running the social media company).

Tweet by tweet, Elon’s new Lex Luther-like reputation, already at an all time low, continues to suffer – along with his credibility on ESG.

ESG may not be the devil, but the risk measurement framework continues to bedevil Elon. Like a degenerate gambler, the more he loses, the more he doubles down. He even resurrected his “ESG is the devil” attack in November. But with each new tweet, the need for stronger ESG regulations and enforcement become more clear.