Greetings! Here’s the latest impact investing deal news.

KKR raises $1.3 billion for Global Impact Fund. The private equity giant launched the fund just under two years ago as an early entrant into the club of private equity firms seeking to raise 10-figure impact funds (see, “For private equity giants, $1 billion is table stakes for entry into impact investing”). KKR hit the billion-dollar mark last summer. Among its investors is KKR itself, which invested $130 million from its balance sheet and employee commitments. KKR Impact’s Robert Antablin declined to comment on how much of the fund has been deployed. The fund has announced four investments and launched a wastewater treatment platform (see Antablin’s post, “Why KKR is investing in wastewater treatment to manage ‘nutrients’,” on ImpactAlpha)

Brazil’s Zetra raises $4.5 million for employer lending and financial health app. Zetra partners with employers to enable employees to tap wages early, instead of taking out loans, and helps employers and employees keep tabs on financial health. Zetra operates in its native Brazil, as well as India, Italy, the U.K. and Portugal (as SalaryFits) and Mexico (as eNomina). Funding from Brazilian tech investor Confrapar will help the company expand SalaryFits into Colombia, Spain and the U.S.

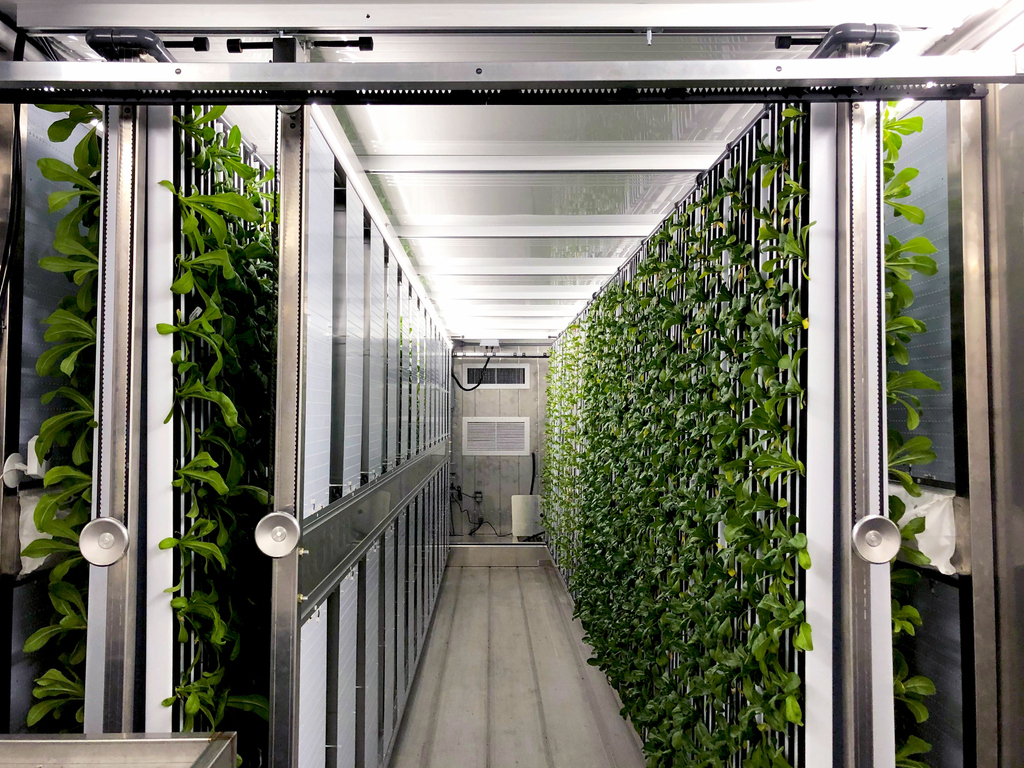

Freight Farms raises $15 million for stackable vertical farms. The Boston-based company repurposes shipping containers for high-tech vertical farming. Freight Farms works with education, hospitality, retail, corporate, and nonprofit customers in 44 states and 25 countries. Freight Farm’s Series B round was backed by sustainable agtech investor Ospraie Ag Science and Spark Capital.

–Feb. 13, 2020