ImpactAlpha, Sept. 15 – How will the energy transition play out? Faster than previously thought.

That’s the message from BP, which released its annual global energy outlook yesterday. The British oil giant painted three scenarios: a rapid transition, where carbon emissions from energy fall by 70% by 2050; net zero, where shifting social norms cut emissions even further; and business-as-usual.

Oil demand peaks around 2019 levels in all three scenarios.

The forecast is in stark contrast to BP’s 2019 outlook – not to mention the views of most of its oil peers – which presumed oil demand will growing for a decade before peeking. Even under BP’s business-as-usual scenario, oil consumption recovers to pre-Covid levels, but plateaus before eventually declining.

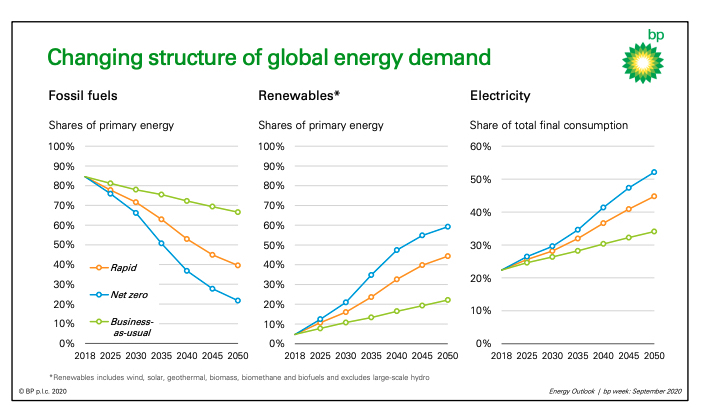

BP sees all fossil fuels – coal, oil and natural gas – falling from about 85% of energy in 2018 to as low as 20% by 2050, in what BP chief economist Spencer Dale called “entirely unprecedented.” Picking up the slack: wind, solar and other renewables.

Driving the transition are increased energy efficiency and the electrification of transportation and industry, as well as rising concern about climate change.

Green infrastructure

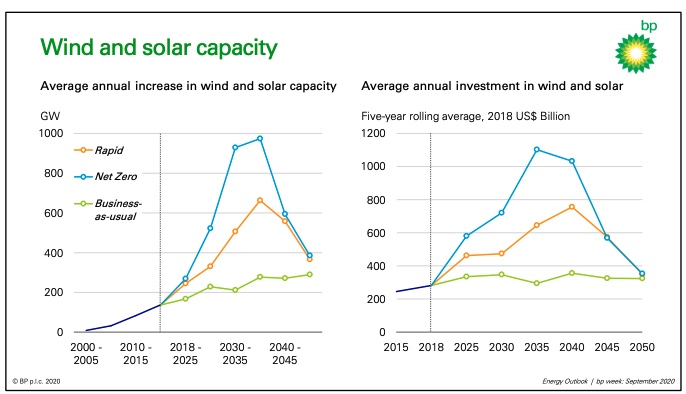

Investment in wind and solar capacity will average $500 to $750 billion a year under the rapid and net-zero scenarios, “several times greater than recent investment levels in wind and solar,” said Dale. BP did its part last week, taking a $1.1 billion stake in two U.S. offshore wind projects by Norway’s Equinor. The wind farms, off the coasts of New York and Massachusetts, could power more than 4 million homes.

As part of a sweeping plan to remake the company into a diversified, low-carbon energy company, BP has said it will increase investment in renewable energy by tenfold.

Policy shift

The rapid transition and net zero scenarios assume a steep increase in carbon pricing, reaching $250 a ton of CO2 in the developed world by 2050 and $175 in emerging economies. “Delaying these policies measures and societal shifts may lead to significant economic costs and disruption,” warns BP. The U.S. Commodities Futures Trading Commission last week called for an economy-wide price on carbon that reflects the full social costs of emissions.

Uncertainties

Covid-19 could reduce global GDP by 4% in 2025 and by almost 10% in 2050, further dampening demand for energy, said Dale. The virus could hasten even the company’s most aggressive scenarios. “It’s possible that the fragilities exposed by Covid-19, together with the growing commitment to build back better – supported by unprecedented levels of government intervention – may help to accelerate the energy transition.”

https://impactalpha.com/climate-week-fusing-climate-action-and-the-sdgs-to-the-covid-recovery/