More than three-quarters of all venture capital investment went to California, New York and Massachusetts last year.

A new bipartisan bill, the “Investing in Opportunity Act,” aims to spread the wealth by tapping the $2 trillion in unrealized capital gains in stocks and mutual funds.

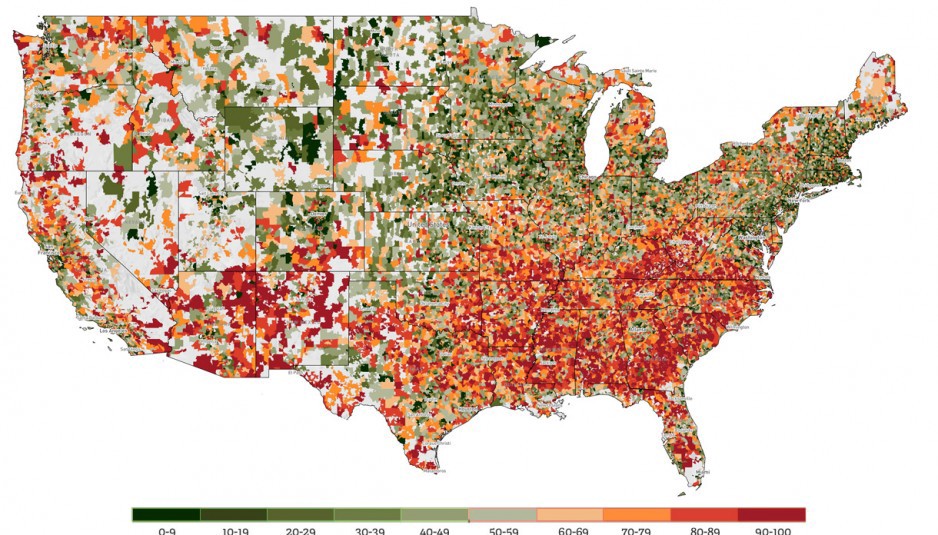

The bill would set up “Opportunity Funds” in underserved “Opportunity Zones.” Investors could defer capital gains taxes by investing in the zones along with other investors. That would “increase the scale of capital while mitigating the risk to any individual investor,” according to John Lettieri and Steve Glickman of the Economic Innovation Group.

They say the bill would “unlock a nationally-scalable source of private capital that can be channeled for maximum local impact and protect the taxpayer from unnecessary cost and risk.”

Support for the bill

On Twitter, AOL founder Steve Case, Hillbilly Elegy author and investor J.D. Vance praised the bill. Village Capital’s Ross Baird and California small business investor Pacific Community Ventures also voiced supported when asked by ImpactAlpha.

“Love this bill! Too many barriers baked into current VC system to invest in the best long-term ideas,” tweeted Baird, whose business accelerator and venture fund seeks to bridge the funding gap for startups outside of Silicon Valley (see, Ross Baird has a plan to build businesses and create jobs in rural America).

“We love the idea — market-based incentives that marry impact and local investing,” posted PCV, which has a new report out on how a St. Paul, Minnesota foundation is experimenting with local investments in the mid-west (see, How the Northwest Area Foundation creates good rural jobs).

Today’s $45 billion in annual corporate tax incentives aimed at luring local jobs and investments aren’t working, according to a new analysis from the W.E. Upjohn Institute for Employment Research. PCV added added that policymakers “realize states are out-corporate-subsidying each other in a race to the bottom.”