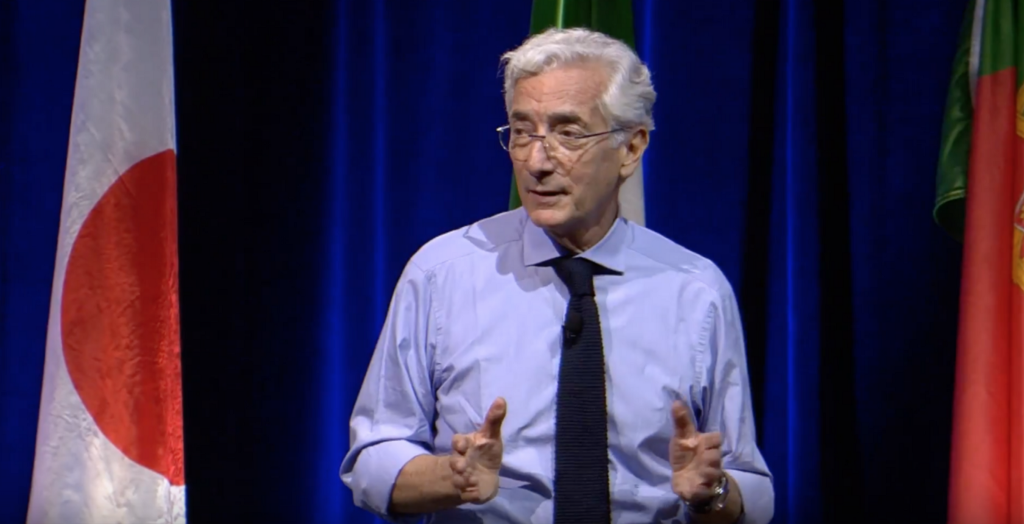

At the GSG Summit of social activists and investors in Chicago last month, Sir Ronald Cohen, a British venture capitalist turned impact investor, suggested that a Nobel prize awaits the economist that goes beyond the standard investing concepts of risk and reward and “best frames the interaction between risk, reward and impact.”

https://medium.com/media/3c6c2f4c52b6835f1ecba7cce5ddf399/href

More capital would be directed towards achieving social and environmental benefits if impact investments can show they can reduce stakeholder risk, cut the cost of capital, help recruit talent and boost financial returns by uncovering new kinds of profitable investing opportunities, Cohen said.

Then came the results of a small but high-profile experiment in social impact investing out of St. Petersborough, England. A third-party evaluation showed that world’s first social impact bond helped reduce recidivism of ex-offenders in the St. Petersborough prison system. The private investors who helped finance the program were repaid with interest from the local government.

“It is very gratifying to see the world’s first social impact bond do good and do well,” said Cohen, who helped launch the bond in 2010. The investment succeeded in “helping released prisoners lead better lives and, as a result, paying back investors’ capital with a reasonable return and saving the government money,” he added.

For St. Peterborough bondholders, risk, reward and impact aligned.