Editor’s note: The shareholder representative nonprofit As You Sow has borne the brunt of the coordinated backlash against corporate and investor action on climate, diversity, and ESG. At stake is the future of fiduciary duty and the understanding of material risks. ImpactAlpha has invited As You Sow CEO Andy Behar to chronicle the action in Fiduciary Future, a series of dispatches from the front lines. Have a reaction, or a dispatch of your own? Drop us a note.

I was thrilled to participate in a recent debate on the merits of ESG hosted by the Center for the Philosophy of Freedom at the University of Arizona. I wasn’t sure what to expect from a forum sponsored by the National Review and founded by a Koch Brothers grant.

Overall, it was a lively and thoughtful discussion. Robert Gibbs (former press secretary for President Barack Obama), Sandra Taylor (former SVP of corporate responsibility at Starbucks) and me held down the pro-ESG side. And Ari Fleischer (former press secretary for George W. Bush), Kevin Hassett (Chair of former-President Trump’s Presidential Council of Economic Advisors), and Kimberly Yee (Arizona State Treasurer) were on the side of anti-ESG.

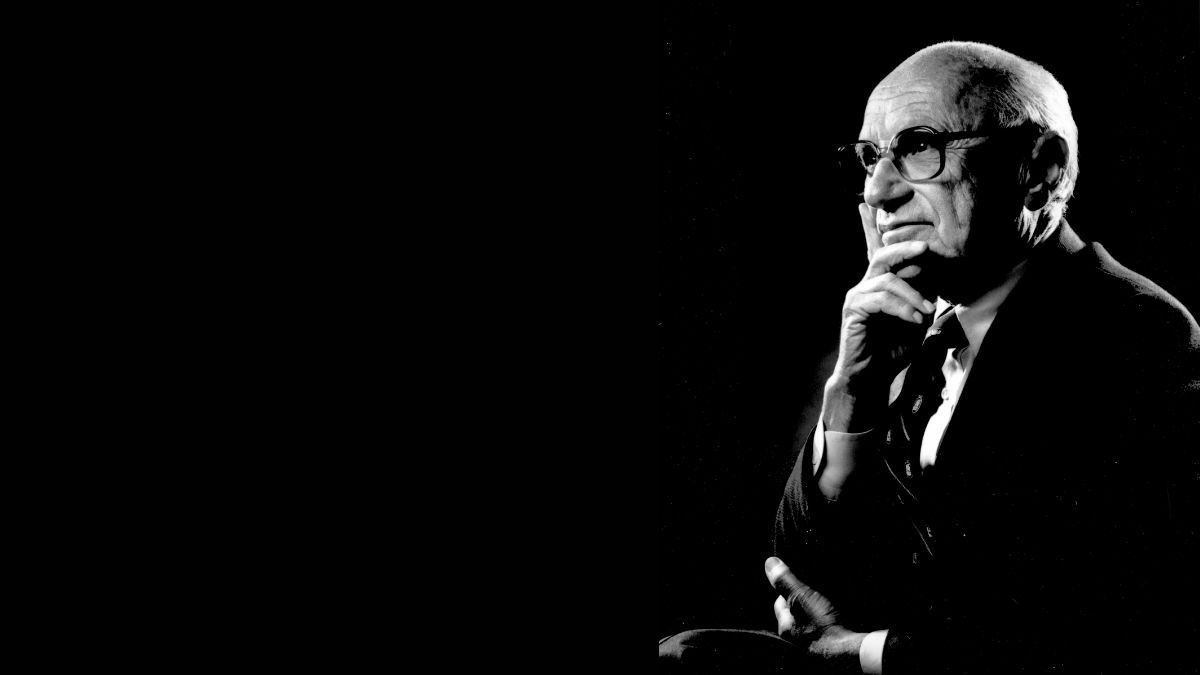

A standout moment was when a good portion of the audience leapt to their feet to “boo” my statement that Milton Friedman economics (aka neoliberalism) had failed.

I stand by my assessment and believe that Friedman, were he alive today, might even agree. Nobel laureate and Columbia economics professor Joseph Stiglitz would also agree, as he explained in a recent Washington Post op-ed, “Time is up for neoliberals.”

“We’ve now had four decades of the neoliberal ‘experiment,’ beginning with Ronald Reagan and Margaret Thatcher,” Stiglitz wrote. “The results are clear. Neoliberalism expanded the freedom of corporations and billionaires to do as they will and amass huge fortunes, but it also exacted a steep price: the well-being and freedom of the rest of society.”

The “Friedman doctrine” was famously published in 1970 as an attack on what today we would consider ESG. Consumer advocate Ralph Nader, leading “Campaign GM,” had filed a shareholder resolution asking General Motors to create a “Shareholders’ Committee for Corporate Responsibility,” and to add three additional members of the board to represent the public interest.

Much like today’s attacks on ESG, an assumption of Friedman’s doctrine was that corporations could not simultaneously address environmental and social challenges while maximizing short-term profits.

Climate inflation

Friedman’s doctrine helped lead to decades of corporations externalizing their costs by dumping pollution onto the commons. As the human population jumped from 3.6 billion in 1970 to over 8 billion today, the carrying capacity of our atmosphere, oceans, and forests are past the breaking point.

Carbon emissions have destabilized global temperatures, causing heat waves, droughts, flooding, and superstorms. Oceans are drowning in plastics causing marine ecosystems to fail. Microplastics are now found in seafood, our blood, and mothers’ milk around the globe. The price of raw commodities including olive oil, coffee, chocolate, and cotton are skyrocketing due to climate inflation.

In 2019, in part spurred by the the recognition that climate-induced negative feedback loops had wreaked havoc on global supply chains, 181 CEOs of the Business Roundtable, representing the world’s largest multinational corporations, signed the New Purpose for a Corporation. Effectively speaking for “the free market,” the Roundtable committed to “promote an economy that serves all Americans.” That effectively moved away from Friedman’s emphasis on short-term profits and toward long-term benefits for all stakeholders, including shareholders, employees, customers, supply chain, and communities where they operate.

The New Purpose of corporations was not a shift away from profits as much as a shift in the time-horizon for when those profits are realized. Today, most investments are made on behalf of retirees, extending the time horizon like never before. Most companies now have sustainability teams to maximize long-term growth, while addressing the needs of all stakeholders. Friedman’s goal was to stop corporations from addressing social concerns; the result was the opposite.

Anti-business

During the debate in Arizona, even Hasset, who is strongly against ESG, said he would have signed the New Purpose of a Corporation in 2019 (see the video at about 43:00). His reason: he would have feared shareholder blowback. But that is a red herring. Influential Roundtable CEOs signed because the free market must adapt or be crushed under the weight of its own short-term “success.”

Alas, the invisible hand of the market’s shift toward stakeholder capitalism triggered an orchestrated anti-ESG crusade, in five waves.

First, a public communications assault on the letters E, S, and G to demonize the acronym.

Second, writing and filing hundreds of state bills (154 bills in 28 states are currently being considered) that make sustainable investing illegal.

Third, a swarm of anti-ESG shareholder resolutions.

Fourth, litigation against corporations designed to waste corporate resources and undermine the relationship between investors and portfolio companies.

And fifth, and finally, a House committee’s investigations of 14 banks, asset managers, proxy advisors, investment advisors, and non-profits (including As You Sow) for alleged antitrust activity.

Right-wing billionaires and oil barons are behind the well-funded anti-ESG crusade designed to stop the global energy transition and to prop up the fossil fuel industry. Utilizing big government to oppose the free markets, it intentionally wastes corporate resources, undermines the authority of boards of directors, the SEC, and the rights of shareholders.

As otherwise-conservative business groups and corporations have said, anti-ESG actions are anti-business, anti-capitalist, anti-freedom, and anti-conservative.

Even with massive resources brought to bear in this coordinated attack on capitalism, it will ultimately fail. Free market forces always prevail. Even the Becker Friedman Institute for Economics at the University of Chicago, founded by Milton Friedman, now teaches stakeholder capitalism.

Rather than admit the world has moved on, regressive thinkers stuck in the Reagan 1980s, including my counterparts in the debate, are fighting the same “free market” forces that they once championed.

It’s time to stop attacking ESG, let the extractive economy wind down, and allow the free market to innovate and prosper into a more sustainable future. That’s something the whole planet can stand up to applaud.

Andrew Behar is CEO of As You Sow, a non-profit leader in shareholder advocacy. Founded in 1992, As You Sow harnesses shareholder power to create lasting change and align investments with values.