ImpactAlpha, July 14 – San Francisco and London-based Generation Investment Management, the $36 billion investment firm founded by Al Gore and David Blood, has for five years previewed the “sustainability revolution” in its annual trends report.

“This year the penny dropped,” says Generation’s Lila Preston, as the confluence of crises thrust long-term sustainability trends into the consciousness of consumers and onto the agenda of policymakers.

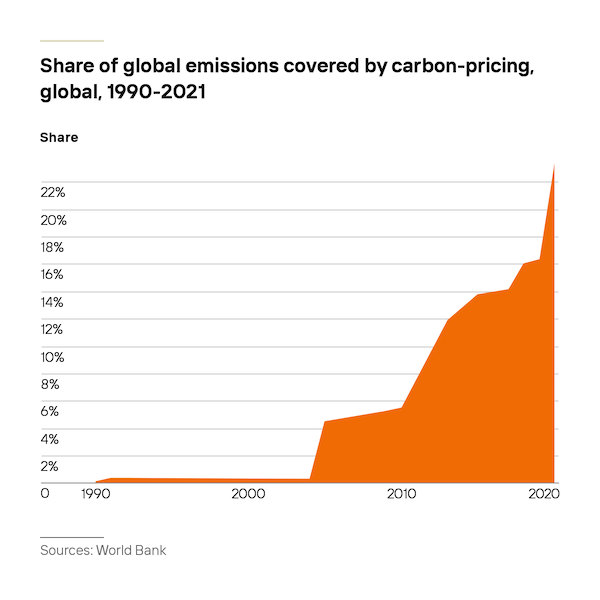

This year’s report charts the capital allocations and commitments, falling cost curves and technological innovation, and customer demand and social awareness driving the shift. Pick your metric: The report notes a “step-change” over the last five years in flows in sustainable finance, including the 10-fold increase in flows to ESG funds in Europe and the tripling (from 2% to 6%) of the share of market capitalization companies focused on the green economy now command among global listed equities.

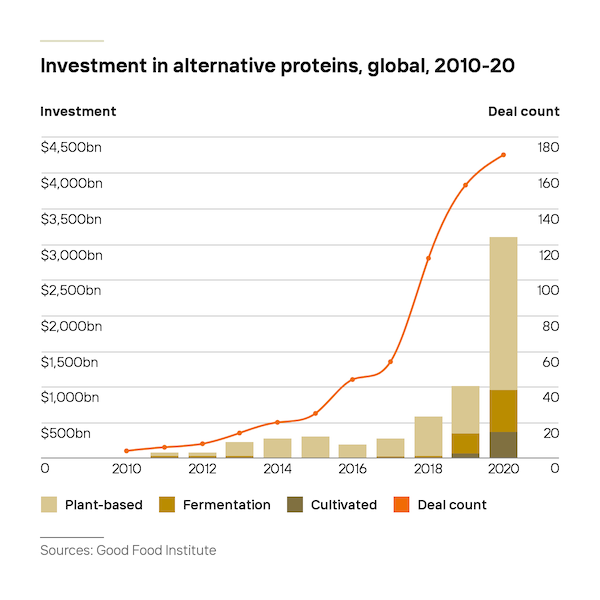

“There is a recognition from a lot of different angles that sustainability is an imperative for our economic systems,” Preston says.

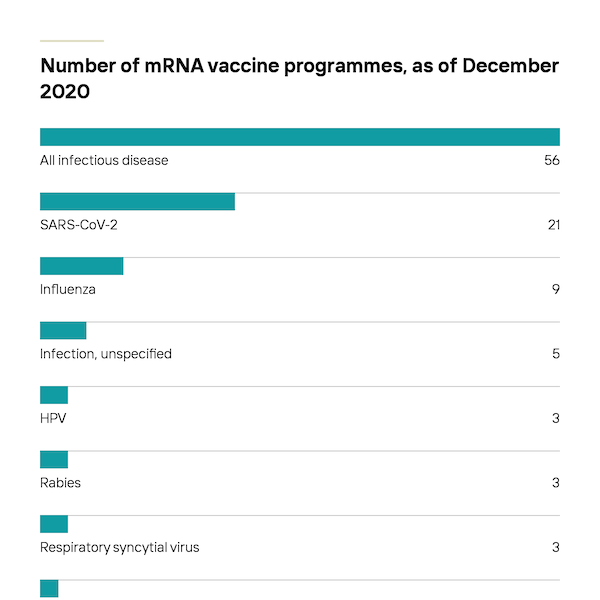

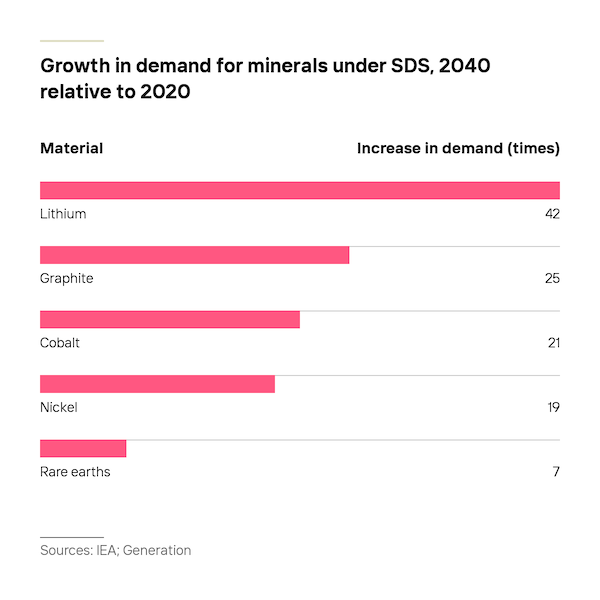

The accelerated adoption of alternative proteins, electric mobility, sustainable building materials and other trends long tracked by Generation “are doing what we would have thought they would do,” says Preston. Now on the radar: the impact of net-zero commitments on mineral prices, the boom in telehealth and mRNA interventions for diseases from cancer to rabies.

To be sure, costs and benefits remain wildly unequal, and negative trends may yet overwhelm positive ones. COVID-19 stimulus spending, for example, averaged more than $8,500 per person in rich countries, compared to $25 per person in poor countries. Nature loss threatens more than half of the world’s GDP, or $44 trillion in economic value.

ImpactAlpha dug through the 200 sources in this year’s report to pick two dozen trends shaping the sustainability revolution.

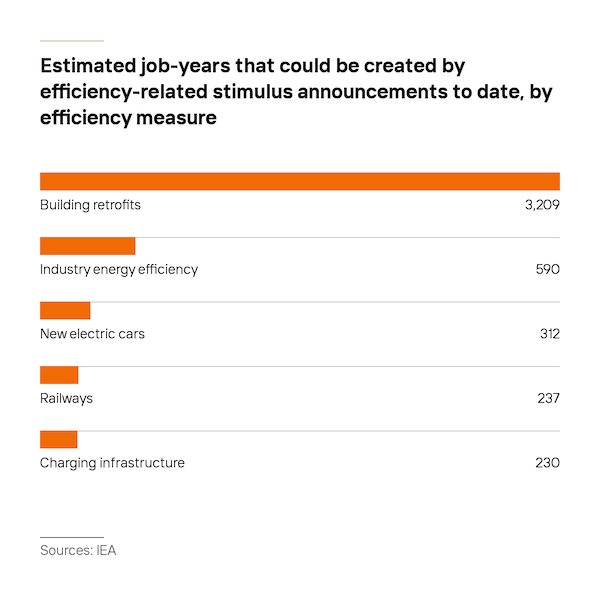

1. The shift to sustainability can generate millions of jobs to lead the economic recovery.

2. Carbon markets now cover nearly a quarter of global greenhouse gas emissions.

3. Alternative protein investing is hot and getting hotter.

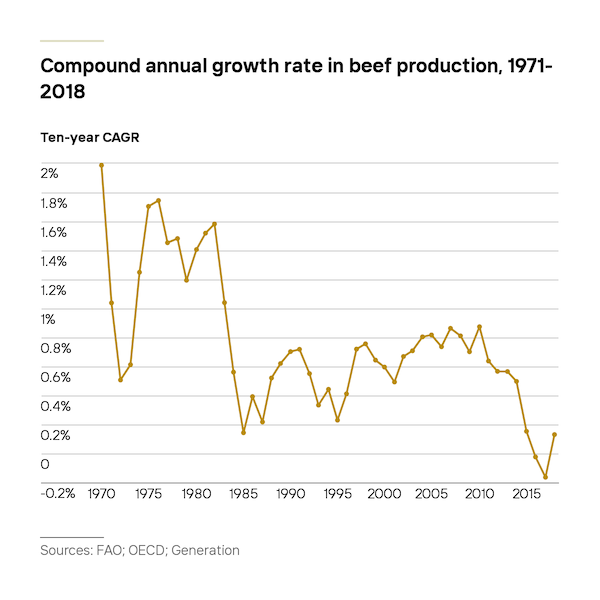

4. The disruption of the global food industry is only beginning.

5. Net-zero targets continue to proliferate.

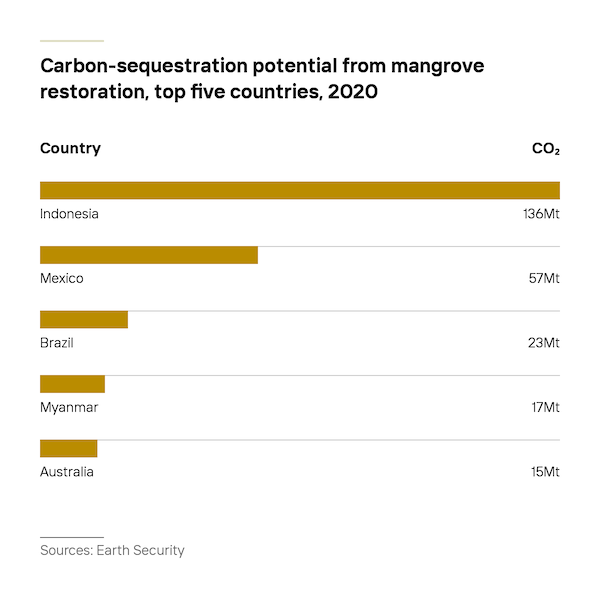

6. Some countries are natural-solutions superpowers.

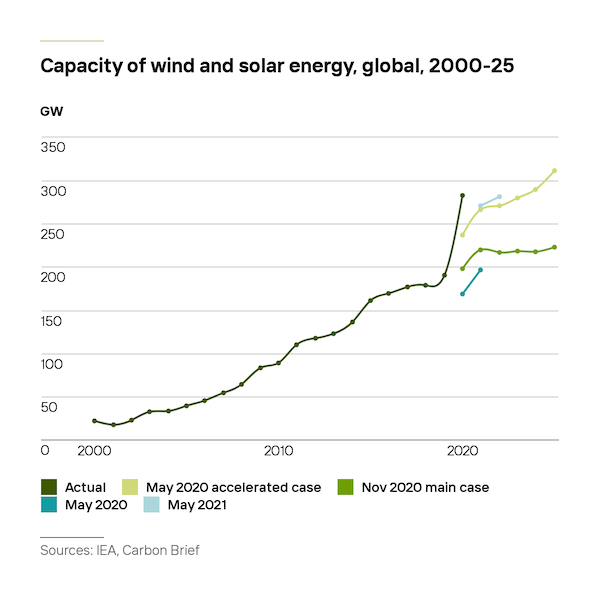

7. 2020 marked an inflection point for renewable energy capacity.

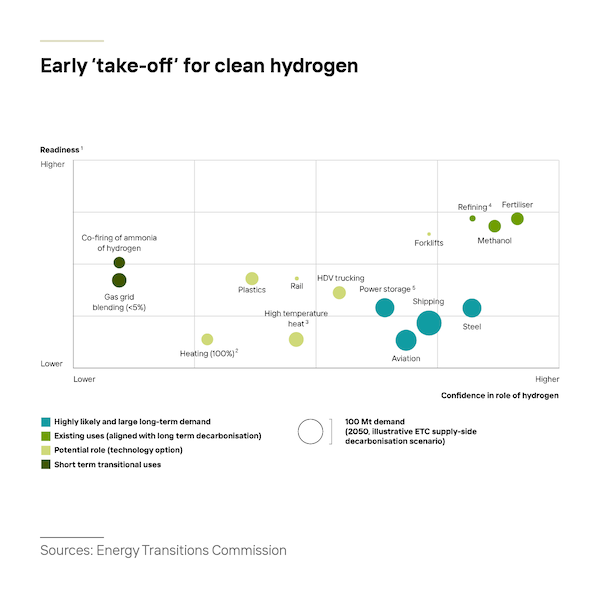

8. Green hydrogen is key to the decarbonization of aviation, steel and shipping.

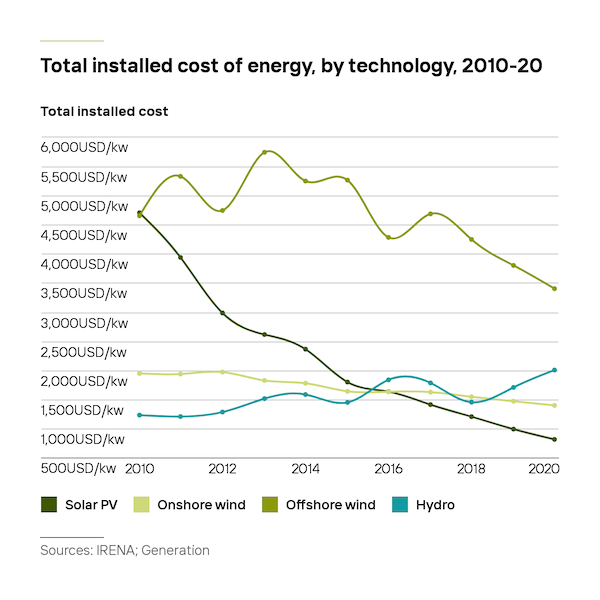

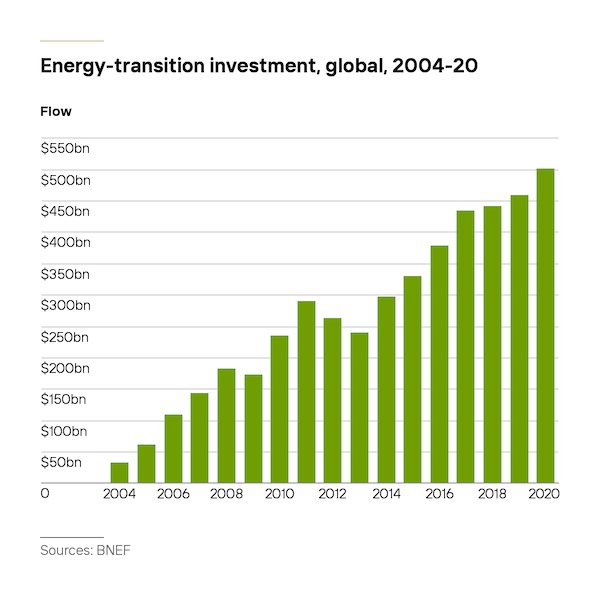

9. The falling costs of renewables…

10. …and growing energy-transition investments are putting more clean electricity on the grid.

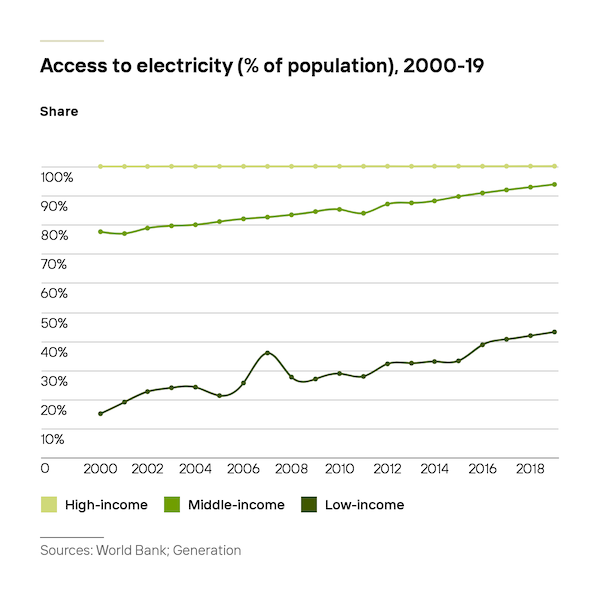

11. Access to energy is expanding around the world.

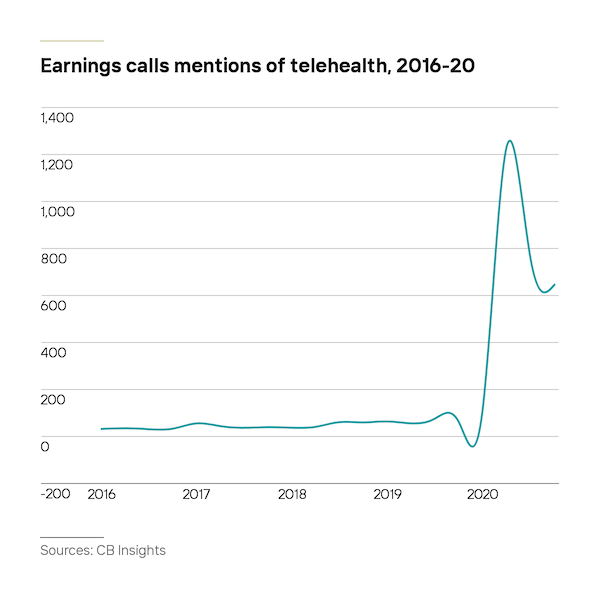

12. COVID-19 changed healthcare delivery – and could improve outcomes.

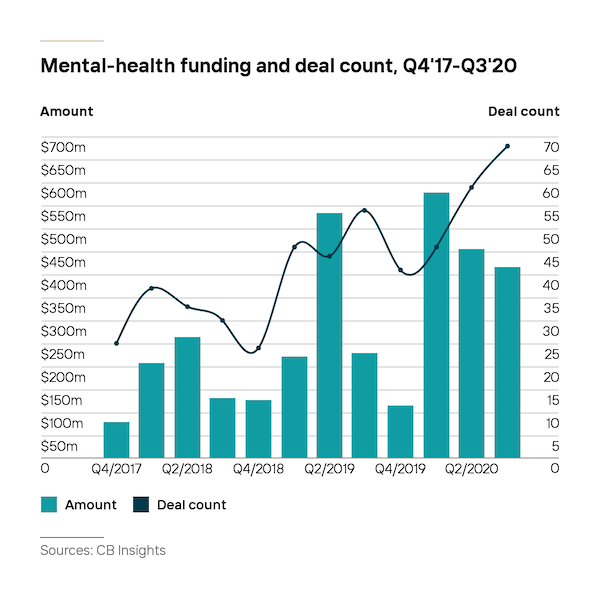

13. Mental health and wellbeing are proving to be investable.

14. COVID-19 opened a path for a new era of vaccine technology.

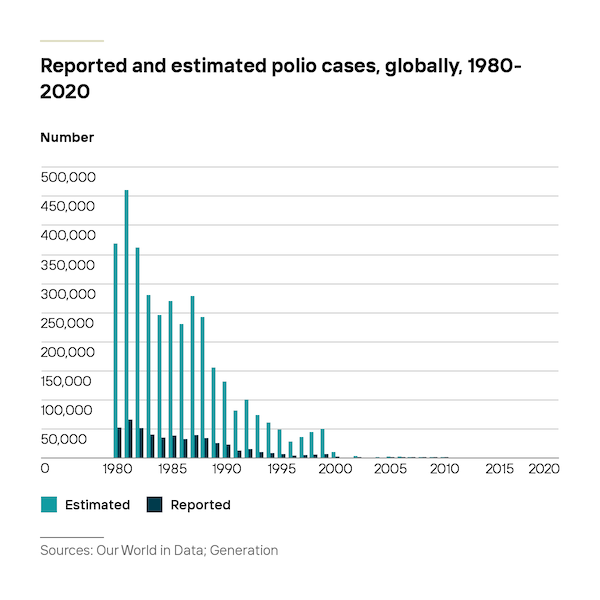

15. Africa has eradicated wild polio, though pockets of concern remain.

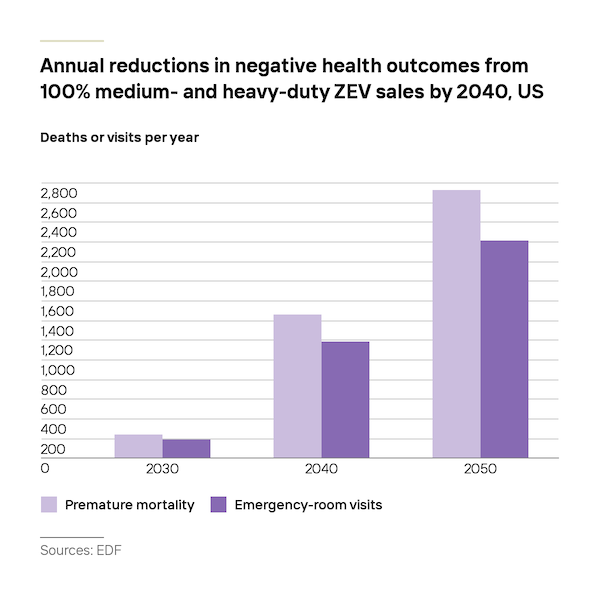

16. The switch to electric vehicles means fewer deaths and hospital visits.

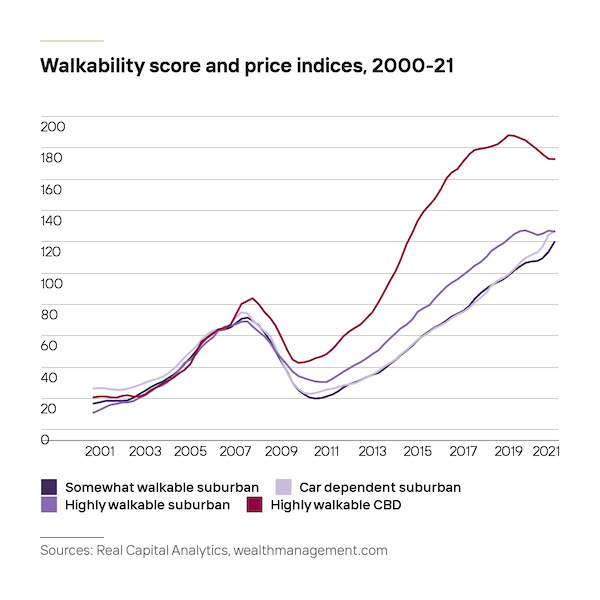

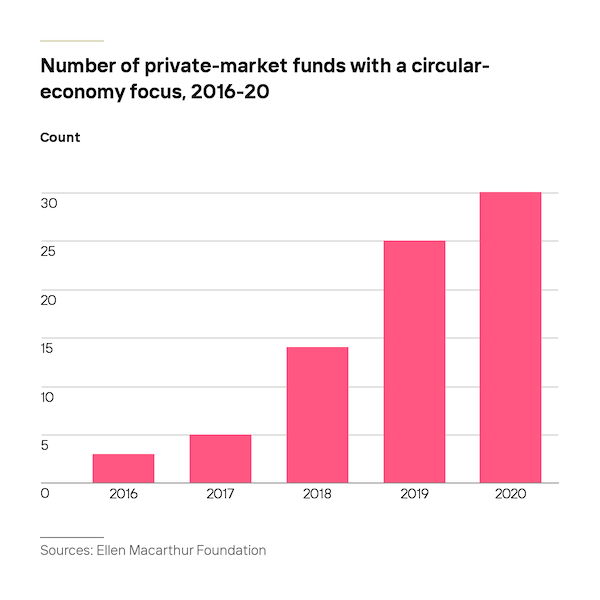

17. Walkability makes cities more vibrant – and valuable.

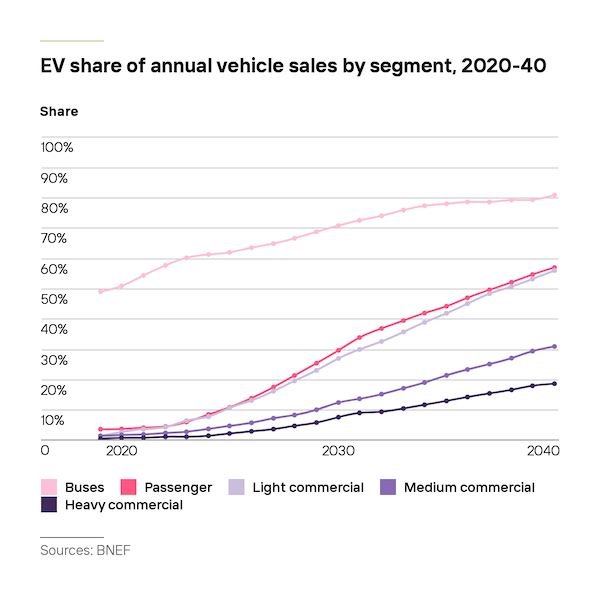

18. It’s not just cars. All types of vehicles are going electric.

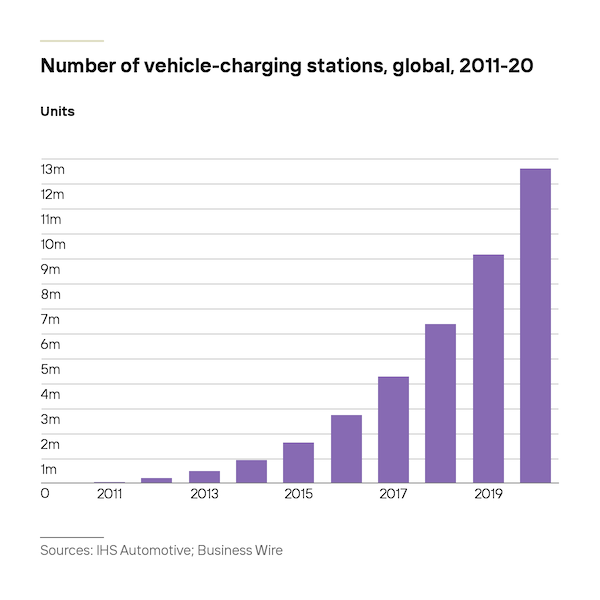

19. Installations of charging stations are soaring…

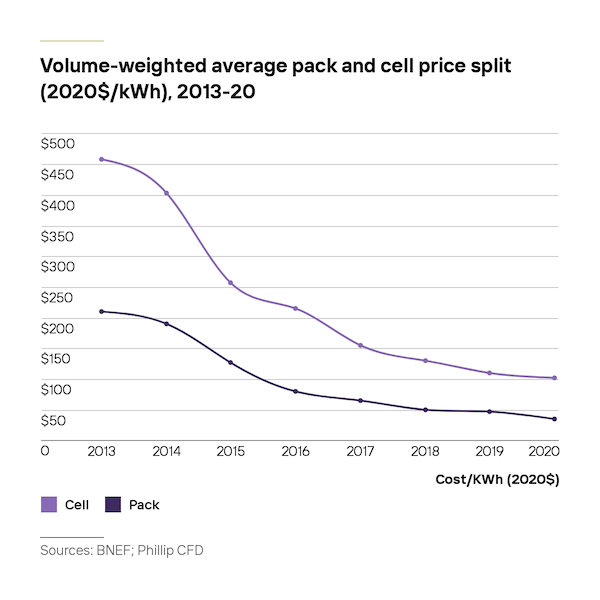

20. …and batteries are riding declining cost-curves.

21. Electrification is driving demand for minerals and reshaping commodity markets.

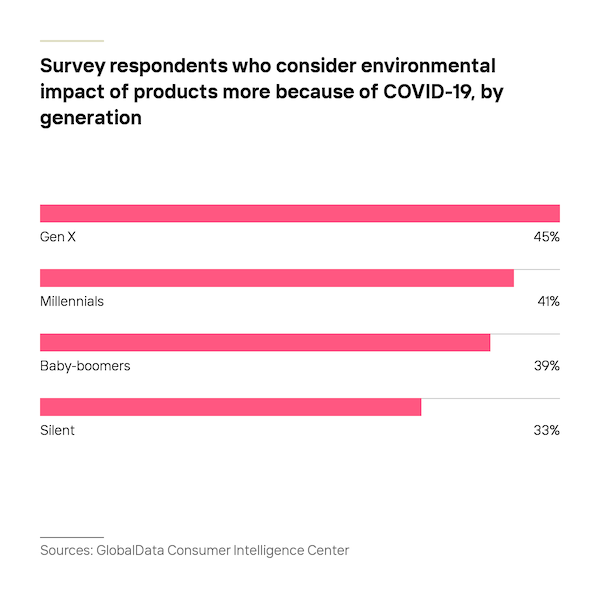

22. The pandemic made consumers think about environmental impact.

23. Investor interest is rising in businesses that design out waste and pollution.

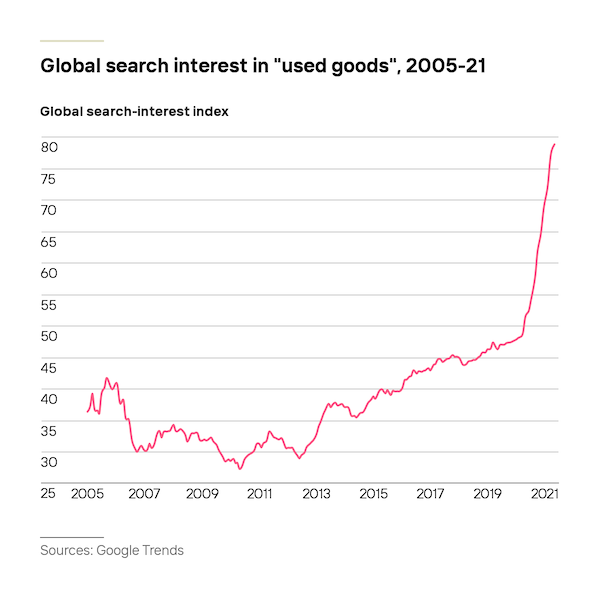

24. Interest in used cars, clothes and other goods takes off.

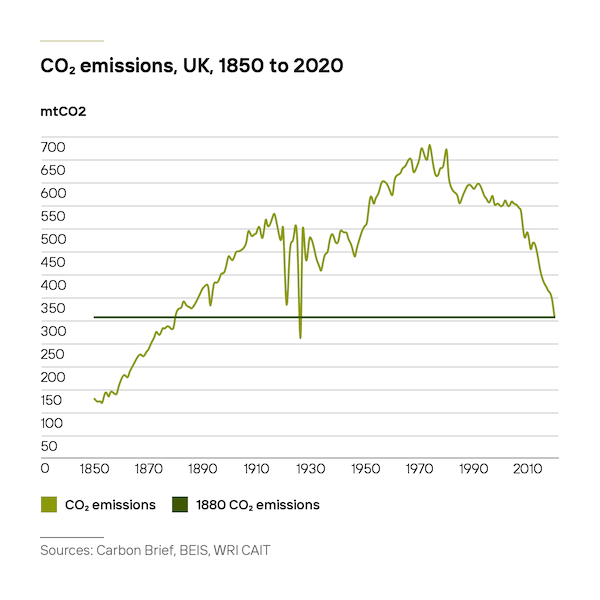

Bonus chart: Carbon emissions in the UK are back to 1880s levels – a drop largely achieved via reduced coal consumption.