We recently met Ajay, a fruit vendor in Mumbai who struggles to pay the 60 percent annual interest rate on a loan from his local money lender.

Ajay was saddled with this debt, unable to refinance or raise more capital to buy a second fruit cart. Last month, that changed. Using just his mobile phone, Ajay got a 15,000 rupee (£185) loan from one of India’s largest private banks, at a moderate interest rate. It took five minutes.

Rajesh has a similar story. He got a 50,000 rupee (£615) working capital loan on his cell phone – without stepping out of the mobile phone repair store he owns and runs in Delhi.

Neither filled out lengthy loan applications, submitted complicated documentation, or queued up in bank branches on futile visits. Their reaction: “Mujhe yakeen nahi hota ki aisa bhi ho sakta hai” (I cannot believe that this is even possible).

This revolution in access to credit was made possible through the digital infrastructure created by ‘India Stack’ – the set of powerful open and programmable capabilities that build on India’s digital ID program Aadhaar.

Capital gap

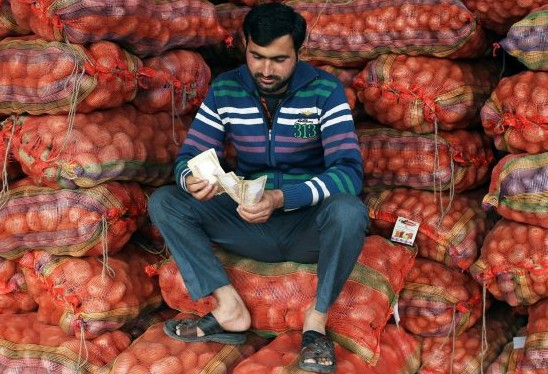

India has a huge credit gap: 90 percent of all small businesses are dependent on informal sources for credit. These micro-entrepreneurs are grossly underserved by traditional lenders because they typically do not have collateral or credit histories that make them “lend-able.”

Microfinance took the first step in meeting this need using joint liability as a proxy for lend-ability. Our research on two recently concluded proof-of-concept experiments suggests that we are now at the cusp of something bigger – lending to micro-entrepreneurs like Ajay and Rajesh, for small loan amounts, at flexible terms, instantly, in a sustainable way where lenders make money (our full report is here).

India Stack disrupts the market for small loans in two ways. First it uses customers’ digital transaction data (remittance flows, phone recharge top-ups, social media footprint, etc., that customers agree to share) for credit appraisal and loan product design. This circumvents the need for documents such as bank statements, collateral documents, and tax returns, which most micro-entrepreneurs don’t have anyway.

Second, it dramatically lower the costs of serving customers by simplifying loan processing and replacing the collection and storage of physical documents with digital versions, using Aadhaar-based eKYC (or “know your customer,” how a business verifies the identity of its clients) and eSign, and disbursing loans digitally.

These data flows and cost savings provide flexibility to lenders to design products which better align with low-income customers’ needs. That’s how Ajay got a super-customised loan with terms that work for him and instant disbursement, as opposed to one-size-fits-all loan products available off the shelf today.

Mobile access

Our research shows that consumers like and value the product –they made the effort to learn how to use this new and better channel for credit. With some assistance, even low-income, limited-literacy consumers were able to navigate the workflow quite well – applying for a loan, providing consent to share data, receiving competing offers from lenders, selecting the offer they preferred, completing verification requirements, signing off on the loan agreement using eSign – all on their smartphone. They received the money in their accounts within a few minutes.

To be sure, extra steps need to be taken to make the system more accessible. Loan providers and marketplace vendors need to create more intuitive and multi-lingual user-interfaces as well as provide initial assistance to navigate the experience and build trust in the early stages where familiarity with and trust in the platform is low.

Consumers did not appear to make the link between transacting digitally and creation of data trails that brought them the credit options. Awareness-building around this, so that consumers take active steps to build deeper digital footprints will play an important role in ensuring that the India Stack reaches its full potential.

Lenders and data providers echoed the promise of the India Stack. They acknowledged that they were able to access a new consumer segment at considerably lower cost (Rs. 55-130 a loan or £0.7-1.6). Our analysis shows that fuller integration with elements of the India Stack could bring this down to ~Rs. 30 (£0.36).

Lenders will have to continue innovating to develop better user interfaces, tap other sources of data, and remain in compliance with regulations.

There are also areas that require some regulatory clarity, particularly around the applicability of Aadhaar-based authentication and eKYC processes in the lending business. The government can also push further by supporting consumers to update Aadhaar records (especially mobile numbers), and promoting competition to drive down cost of eSign. Full-scale rollout of the user-payment interface (and subsequent streamlining of auto debit mechanisms) will smooth the payment flows. The DigiLocker which will allow Indians to store (and control access to) their personal digital data further strengthens the value proposition.

Financial inclusion

Over time, the benefits of the India Stack could go much beyond lending. From micro-savings and miniaturized mutual fund investments, to employment registries, the India stack has the potential to improve the lives of every Indian in myriad ways.

Ajay and Rajesh have experienced something that, when done at scale, could truly transform the lives of millions of micro-entrepreneurs in India.

[seperator style=”style1″]Disclosure[/seperator]

Niloufer Memon and Vibhor Goyal also contributed to this piece.

Photo: Reuters/Mukesh Gupta.