Extraction gives way to regeneration. Inequality is trumped by inclusion. The poles of the global financial order are reversed. Human, social and financial capital flows toward a sustainable future, as if pulled by a magnet.

Can’t happen, you say?

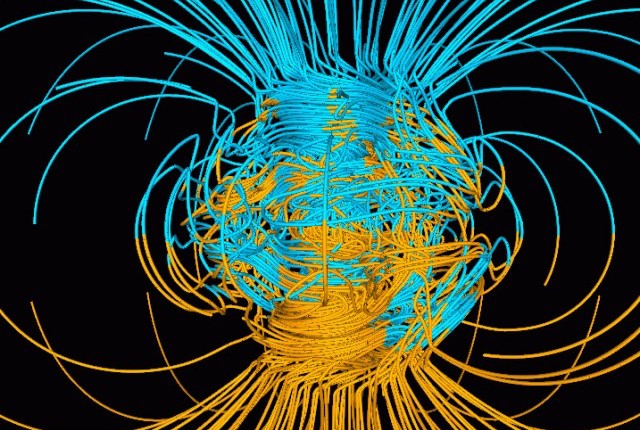

Consider the Earth’s actual magnetic poles, which have reversed at least 183 times in the last 83 million years. North becomes south and south becomes north. The last time was 780,000 years ago, and could have occurred as quickly as a human lifetime. There’s evidence we’re in the early stages of another reversal right now. (Update: “Swarm probes weakening of Earth’s magnetic field.”)

Such a geomagnetic reversal could cause continents to lurch, triggering earthquakes, climate shocks and mass extinctions.

The impact of the reversal of global flows of capital, people and goods, as well as power and ideas, may be no less profound. Call it the low-carbon transition, sustainable development, the regeneration or Gaia. The flip side of those inflection points may be a utopian fantasy. Certainly the transition will include wrenching struggles, disasters and dislocations, violence and greed.

A brighter future is by no means assured. But it is possible. It may be grandiose for a small team, but charting that transformation is ImpactAlpha’s, uh, north star. Reverse the polarity is at the top of our current list of themes and memes with which we try to make sense of impact investing news.

On our Agents of Impact call Thursday, ImpactAlpha’s Dennis Price, Jessica Pothering and I will share some of our other hunches and hobby-horses. Our hope is to enlist your help in expanding and revising the chart so we can better chart the transformation. There’s still time to RSVP for what we expect to be a lively and conversational roundtable that brings you inside ImpactAlpha’s thinking. The Call is scheduled for Thursday, Aug. 1st, at 10:00 am PT / 1:00 pm ET / 6:00 pm London.

We’ll be joined by special agents of impact like Goldman Sachs’ John Goldstein, newly minted head of Goldman’s new Sustainable Finance Group, which is riding the institutional shift toward long-term value creation and risk reduction. Kellogg Foundation’s Cynthia Muller will help us explore the returns on inclusion generated by underestimated entrepreneurs and underserved markets. Rockefeller Foundation’s Adam Connaker is on tap to talk up the value of “full-stack,” or catalytic, capital. RSVP today. Here are some other themes we’re watching.

Risk, adjusted. That the market is slow to price risks related to externalities like climate and inequality means opportunities for some, and shocks for others. Long-term impacts that seem small on an annual basis can get priced in by the markets quickly on a net-present value basis. “In reality, sudden changes in return impacts are more likely than neat, annual averages,” says consulting firm Mercer.

Investors got hammered when PG&E filed for bankruptcy after devastating California wildfires, and by GE’s slowness in recognizing the shift to renewable energy. BlackRock warns investors still are discounting risks already lurking in their portfolios. Which raises a compelling question: accounting for environmental, social and governance factors, or ESG, lowers risks, the inverse must also be true: portfolios not screened for ESG contain undisclosed and uncompensated risks. Are asset managers that don’t account for ESG exposing their clients to uncompensated risks?

Risk, adjusted: BlackRock and Mercer signal the repricing of climate risk

Institutional shift. Long-term investing pension funds and other “universal owners” can’t dodge systemic risks. “When the systemic risks hit the market, all our efforts to beat the market are not going to be good enough,” says Hiro Mizuno, chief investment officer of Japan’s $1.6 trillion Government Pension Investment Fund. “We should make the capital markets sustainable.” GPIF two years ago required all its asset managers to integrate environmental, social and governance factors into their analysis, triggering a sea-change in asset management.

Returns on inclusion. Explicit and implicit biases destroy value. Overcoming bias creates value. That’s the business case for gender and racial inclusion. At its portfolio summit in Detroit this summer, the W.K. Kellogg Foundation doubled down on its commitment to interrupt implicit bias, build more diverse teams and intentionally invest in diverse founders and underserved markets.

How Kellogg Foundation is interrupting racial bias in capital markets

Resistance meets revival. Green jobs, shared prosperity, healthy environment, thriving communities. New revivalists are tackling challenges and offering an antidote to division and despair in towns and cities across the country. Among the solutions: Go to overlooked places. Solve real problems. Give entrepreneurs space to grow. Revolving loans make the world go ‘round. Build businesses on revenues, not venture capital. And most importantly, spot hidden and underestimated talent.

Share the wealth. Rising income inequality is a systemic risk. Good jobs, cooperatives, community ownership stakes in investment funds: a growing number of business and financial strategies aim to drive wealth down the economic pyramid. HCAP Partners, a San Diego-based manager of about $300 million in assets, has an explicit strategy of job improvement. The notion is that competitive companies need employees who are engaged in a superior way, which requires superior human capital investment.

Lok Capital returns $65 million to investors and raises $80 million more

Full stack capital. Investors are moving toward the impact alpha – and ‘beyond tradeoffs.’ Still, nascent markets, with unproven models and in particular, those that serve low-income customers – may require ‘catalytic’ capital. Some “blended finance” structures, for example, include catalytic investors who can take higher-risk or lower-return positions in order to attract more commercially minded investors to development projects.

Infect the host. The logic worms its way into the machine, the virus infects the host. “Legacy” (aka mainstream) investors have become the fastest-growing segment of impact investors. Inside the new hybrids, sustainable and impact investment strategies live side-by-side with increasingly outdated conventional approaches. In nearly every institution, Agents of Impact are creating products, attracting clients, demonstrating performance and building constituencies. That sets up a natural experiment – and competition between internal teams.

Follow the talent. One bright spot for struggling MBA programs: oversubscribed impact and sustainable finance courses. Student demand for the courses is so high that schools are increasingly requiring prerequisites – boosting broader finance courses that otherwise would be suffering declining enrollment. It’s the same story at every major financial institution — interest in sustainable and impact investing is sky high.

Each week, ImpactAlpha highlights Agents of Impact who are making things happen, have something to say or whom we just think other Agents should know about. Such people are the clearest sign that the polarity of finance is indeed reversing. Agents of Impact are working across issues and geographies and stages and asset classes. You are inside and outside “the system.” Yet you share a mission to move capital – human, social and financial – toward an inclusive and regenerative future.

Join other Agents of Impact on The Call and tell us what you’re seeing – and what to watch for. RSVP today for a lively roundtable that will bring you inside ImpactAlpha’s thinking. Thursday, Aug. 1st, at 10:00 am PT / 1:00 pm ET / 6:00 pm London.