ImpactAlpha, May 10 – Every investment firm aspires to rank in the top quartile of comparable firms. Not many achieve that rank by focusing exclusively on closing opportunity and outcome gaps for underrepresented African-American and Latinx communities.

Mitch Kapor and Freada Kapor Klein released results for Kapor Capital’s Impact Fund. With a 29.02% internal rate of return, the fund beat the 75th percentile benchmarks for Pitchbook (25.96%) and Cambridge (26.5%) between 2011 and 2017.

The Kapor portfolio of more than 100 companies includes justice startups like Pigeonly, the largest independent prison communication services provider, and Promise, an alternative the current exploitative and expensive bail system.

The fund also includes grammar and writing skills platform NoRedInk, Affordable Care Act enrollment channel HealthSherpa, urban-core energy-efficiency firm BlocPower, and payday loan disrupter LendUp. Sixty percent of the companies have a woman founder or founder of color.

Venture capital 2.0

Kapor Capital credits its success to approaching venture capital with a different set of assumptions. Along with its focus on impact, the firm believes a focus on the “lived experience” of underrepresented founders gives it a competitive advantage in tech.

“Their experiences inform the questions they ask, the markets they access and—importantly—the problems they identify that give rise to profitable, tech-driven solutions,” the firm writes in its impact report.

The firm also believes the ‘myth of meritocracy’ limits who gets to identify problems and come up with tech-enabled solutions. Says the firm, “It tells underrepresented founders that it’s their own fault if their career opportunities are limited, and let’s tech bros off the hook for examining their own privileges and limitations.”

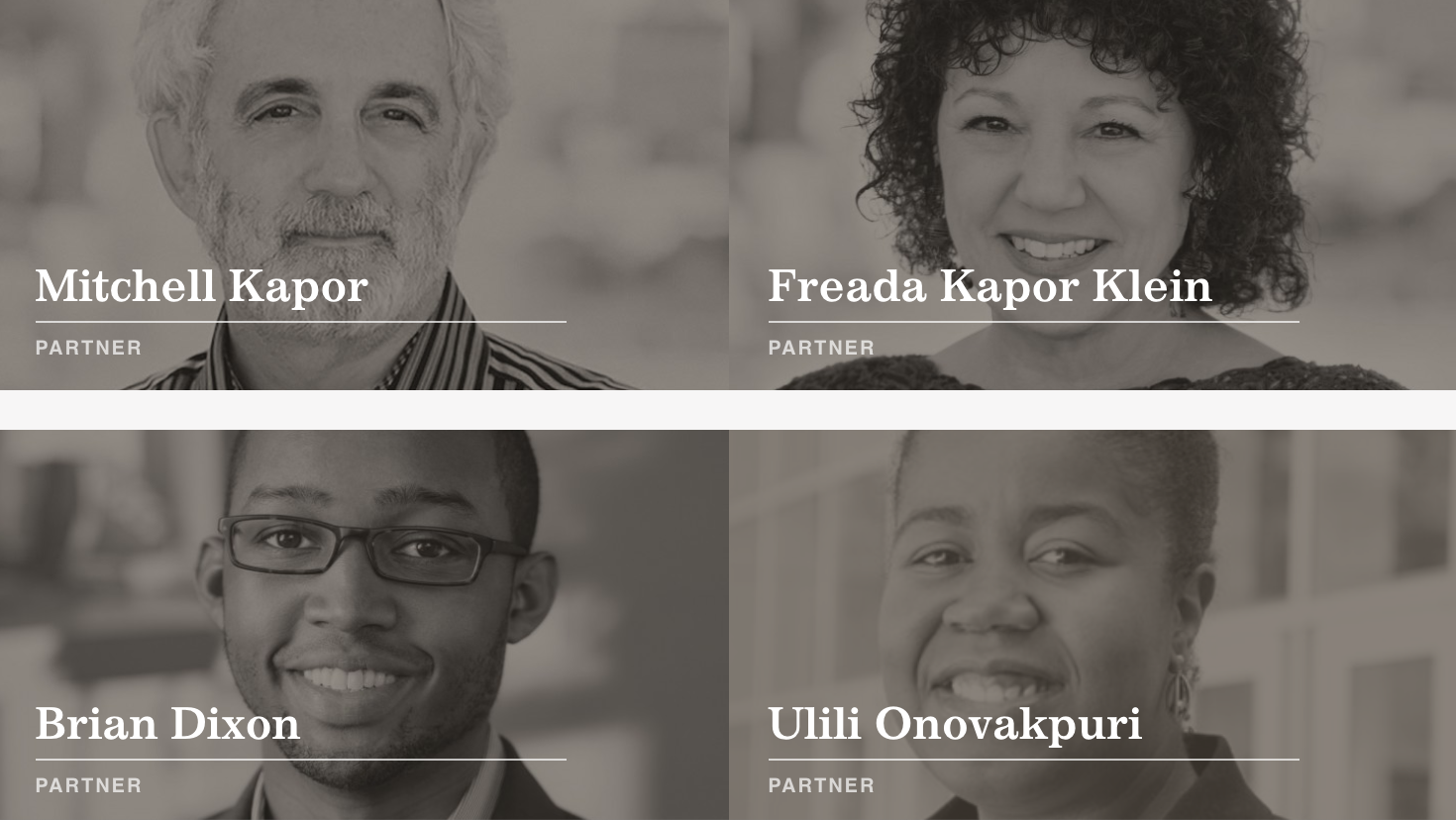

To find diverse talent, Kapor Capital has built a diverse investment team. More than half of the Kapor team are women and primarily from underrepresented backgrounds. Two of its four partners are African-American; a third of the team are Latinx (see, “Brian Dixon: The 34-year-old African-American VC turning inclusion into a competitive advantage“).

“We’ve found that our internal diversity has helped us source underrepresented founders,” the firm writes in its impact report. That “talent that is more likely to create gap-narrowing companies that will change the lives of many people in the U.S. and beyond,” says the firm.