Beyond Trade-offs is an ImpactAlpha podcast series, produced in partnership with Omidyar Network, in which impact investors look across the returns continuum at investment strategies to scale capital for impact.

- Catch up. Take a spin through the full “Beyond Trade-offs” podcast series.

- Don’t miss an episode. Subscribe to ImpactAlpha’s Returns on Investment podcasts on iTunes, Spotify, SoundCloud or Stitcher.

- Read the collection of essays published on The Economist digital hub last year.

In Beyond Trade-offs, prominent impact investors urge their colleagues to move past the polarized debate about whether this fast-growing market is all commercial or all concessionary – and instead embrace its opportunities.

Coming from all corners of the market, these trailblazing investors collectively make the case that the full spectrum of impact investing capital is essential to achieve bold and lasting change.

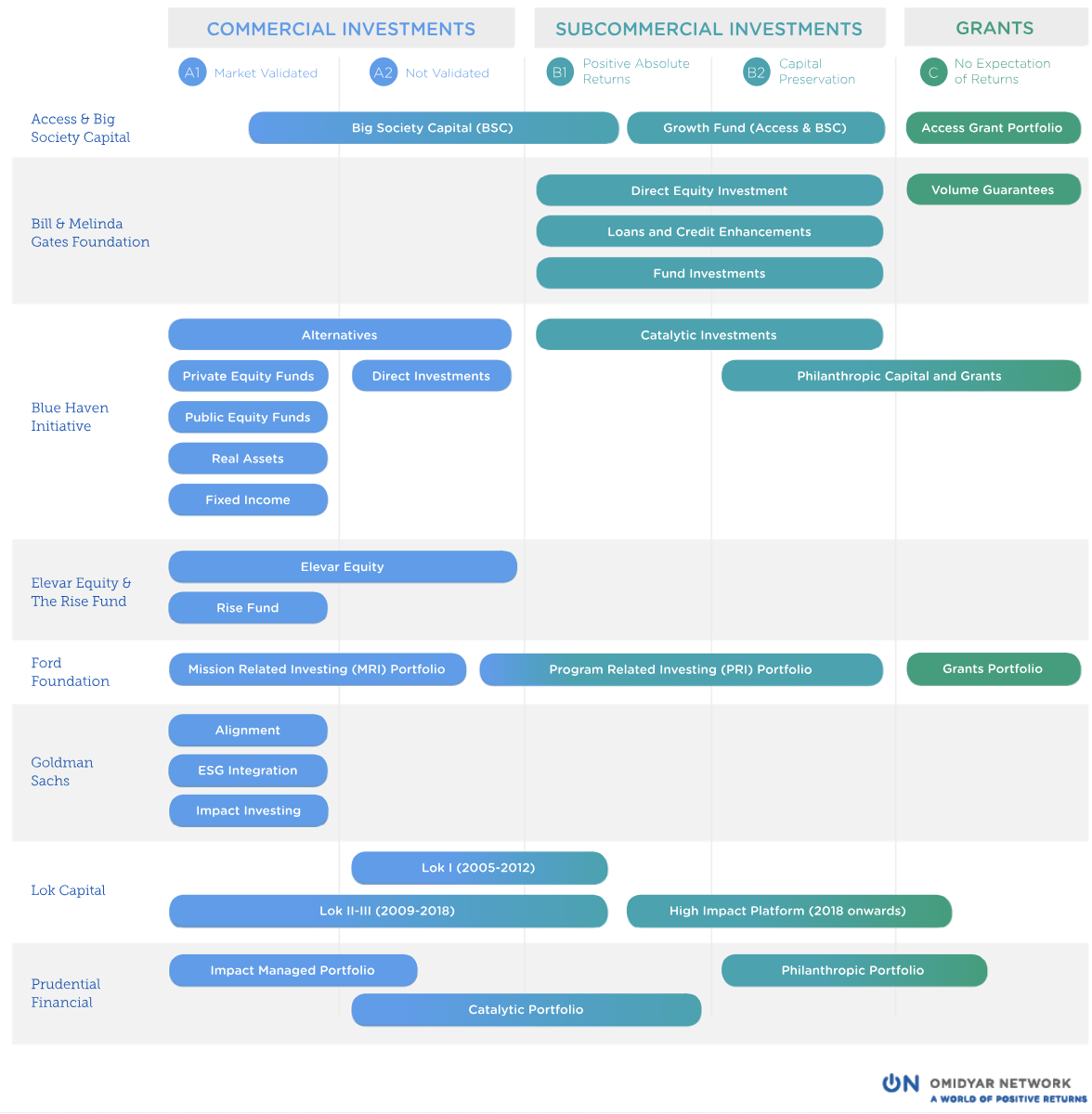

Their shared insight is illuminated by this graphic, which maps the investors in the Beyond Trade-offs series against a simple framework Omidyar Network first shared in Across the Returns Continuum. Each investor invests at different points along the impact investing continuum – careful to match capital with expectations for risk, return and impact in specific market segments.

>>Interactive infographic: Touch or click each button below to see more details about each investment strategy

Complex problems call for all types of capital. Only when we embrace the full continuum – a market in which different investors each play a distinct, vital role – can we realize the potential of impact investing to address the world’s biggest challenges.

See where family offices, foundations, institutional investors and asset managers play – and check out the full series to learn more about the underlying strategies and portfolios of each.